Walgreens 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or payroll deductions up to certain limits. The aggregate number of shares that may be purchased under this plan

is 94 million. At August 31, 2015, 14 million shares were available for future purchase.

Restricted performance shares issued under the Omnibus Plan offer performance-based incentive awards and

equity-based awards to key employees. Restricted stock units are also equity-based awards with performance

requirements that are granted to key employees. The restricted performance shares and restricted stock unit

awards are both subject to restrictions as to continuous employment except in the case of death, normal

retirement or total and permanent disability. In accordance with ASC Topic 718, Compensation – Stock

Compensation, compensation expense is recognized based on the market price of the Company’s common stock

on the grant date and is recognized on a straight-line basis over the employee’s vesting period or to the

employee’s retirement eligible date, if earlier.

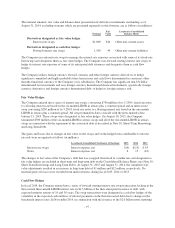

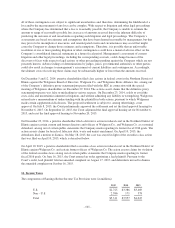

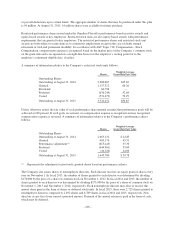

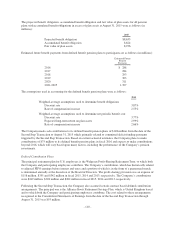

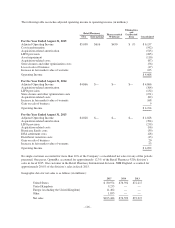

A summary of information relative to the Company’s restricted stock units follows:

Shares

Weighted-Average

Grant-Date Fair Value

Outstanding Shares

Outstanding at August 31, 2014 3,280,067 $45.40

Granted 1,157,312 66.26

Dividends 64,796 —

Forfeited (636,244) 52.68

Vested (531,479) 52.29

Outstanding at August 31, 2015 3,334,452 $50.85

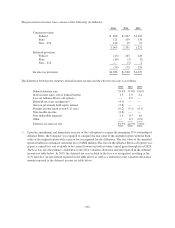

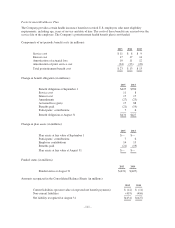

Unless otherwise noted, the fair value of each performance share granted assumes that performance goals will be

achieved at 100 percent. If such goals are not met, no compensation expense is recognized and any recognized

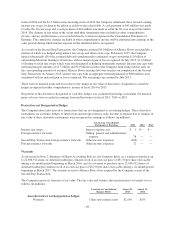

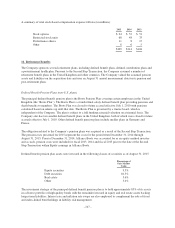

compensation expense is reversed. A summary of information relative to the Company’s performance shares

follows:

Shares

Weighted-Average

Grant-Date Fair Value

Outstanding Shares

Outstanding at August 31, 2014 2,063,132 $ 44.85

Granted 483,174 65.31

Performance adjustment(1) (615,445) 35.30

Forfeited (444,961) 55.00

Vested (40,120) 44.00

Outstanding at August 31, 2015 1,445,780 $ 50.78

(1) Represents the adjustment to previously granted shares based on performance criteria.

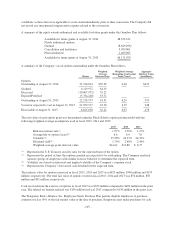

The Company also issues shares to nonemployee directors. Each director receives an equity grant of shares every

year on November 1. In fiscal 2013, the number of shares granted to each director was determined by dividing

$170,000 by the price of a share of common stock on November 1, 2012. In fiscal 2014 and 2015, the number of

shares granted to each director was determined by dividing $175,000 by the price of a share of common stock on

November 1, 2013 and November 1, 2014, respectively. Each nonemployee director may elect to receive this

annual share grant in the form of shares or deferred stock units. In fiscal 2015, there were 2,725 shares granted to

nonemployee directors compared to 2,892 shares and 4,789 shares in fiscal 2014 and 2013, respectively. New

directors in any fiscal year earned a prorated amount. Payment of the annual retainer is paid in the form of cash,

which may be deferred.

- 106 -