US Cellular 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

United States Cellular Corporation (‘‘U.S. Cellular’’) owns, operates and invests in wireless markets

throughout the United States. U.S. Cellular is an 84%-owned subsidiary of Telephone and Data

Systems, Inc. (‘‘TDS’’).

The following discussion and analysis should be read in conjunction with U.S. Cellular’s audited

consolidated financial statements and the description of U.S. Cellular’s business included in Item 1 of the

U.S. Cellular Annual Report on Form 10-K (‘‘Form 10-K’’) for the year ended December 31, 2014. The

discussion and analysis contained herein refers to consolidated data and results of operations, unless

otherwise noted.

OVERVIEW

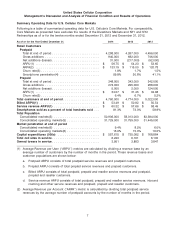

The following is a summary of certain selected information contained in the comprehensive

Management’s Discussion and Analysis of Financial Condition and Results of Operations that follows.

The overview does not contain all of the information that may be important. You should carefully read the

entire Management’s Discussion and Analysis of Financial Condition and Results of Operations and not

rely solely on the overview.

In its consolidated operating markets, U.S. Cellular serves approximately 4.8 million customers in

23 states. As of December 31, 2014, U.S. Cellular’s average penetration rate in its consolidated operating

markets was 15.0%. U.S. Cellular operates on a customer satisfaction strategy, striving to meet or exceed

customer needs by providing a comprehensive range of wireless products and services, excellent

customer support, and a high-quality network. U.S. Cellular’s business development strategy is to obtain

interests in and access to wireless licenses in its current operating markets and in areas that are

adjacent to or in close proximity to its other wireless licenses, thereby building contiguous operating

market areas with strong spectrum positions. U.S. Cellular believes that the acquisition of additional

licenses within its current operating markets will enhance its network capacity to meet its customers’

increased demand for data services. In addition, U.S. Cellular anticipates that grouping its operations into

market areas will continue to provide it with certain economies in its capital and operating costs.

Financial and operating highlights in 2014 included the following:

• Total customers were 4,760,000 at December 31, 2014, including 4,646,000 retail customers (98% of

total).

• Beginning in the second quarter of 2014, U.S. Cellular expanded its offerings for equipment installment

plans. In 2014, 24% of total device sales to postpaid customers were made under equipment

installment plans.

• In December 2014, U.S. Cellular sold $275 million of 7.25% Unsecured Senior Notes due 2063 and will

use the proceeds for general corporate purposes, including spectrum purchases and capital

expenditures. See Note 11—Debt for additional details.

• In December 2014, U.S. Cellular entered into an agreement to sell 595 towers outside of its Core

Markets for approximately $159 million. Concurrently, U.S. Cellular closed on the sale of 236 towers,

without tenants, for $10.0 million, recorded a gain of $3.8 million to (Gain) loss on sale of business

and other exit costs, net and received $7.5 million in earnest money. The closing for the remaining

359 towers, primarily with tenants, occurred in January 2015, at which time U.S. Cellular received

$141.5 million in additional cash proceeds and recorded a gain of approximately $107 million.

• In December 2014, U.S. Cellular completed a license exchange primarily in Oklahoma, North Carolina

and Tennessee. As a result of this transaction, a gain of $21.7 million was recorded in (Gain) loss on

license sales and exchanges in the Consolidated Statement of Operations.

• In March 2014, U.S. Cellular sold the majority of its St. Louis area non-operating market license for

$92.3 million. As a result of this sale, a gain of $75.8 million was recorded in (Gain) loss on license

sales and exchanges in the Consolidated Statement of Operations.

1