US Cellular 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

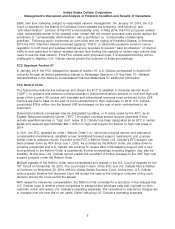

Operating Revenues

Service revenues

Service revenues consist primarily of: (i) charges for access, airtime, roaming, recovery of regulatory

costs and value added services, including data products and services, provided to U.S. Cellular’s retail

customers and to end users through third party resellers (‘‘retail service’’); (ii) charges to other wireless

carriers whose customers use U.S. Cellular’s wireless systems when roaming; and (iii) amounts received

from the Federal USF.

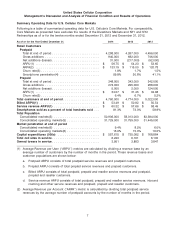

Retail service revenues

Retail service revenues decreased by $152.5 million, or 5%, to $3,013.0 million due primarily to a

decrease in U.S. Cellular’s average customer base (including the reductions caused by the Divestiture

Transaction and NY1 & NY2 Deconsolidation), partially offset by an increase in billed ARPU.

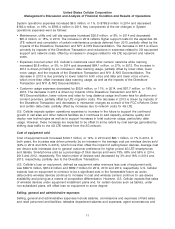

In 2013, Retail service revenues decreased by $382.5 million, or 11%, to $3,165.5 million due primarily to

a decrease in U.S. Cellular’s average customer base (including the reductions caused by the Divestiture

Transaction and NY1 & NY2 Deconsolidation) and a slight decrease in billed ARPU. In the fourth quarter

of 2013, U.S. Cellular issued loyalty reward points with a value of $43.5 million as a loyalty bonus in

recognition of the inconvenience experienced by customers during U.S. Cellular’s billing system

conversion in 2013. The value of the loyalty bonus reduced Operating revenues in the Consolidated

Statement of Operations and increased Customer deposits and deferred revenues in the Consolidated

Balance Sheet.

Billed ARPU increased to $53.49 in 2014 from $50.73 in 2013. This overall increase is due primarily to an

increase in postpaid ARPU to $56.75 in 2014 from $54.31 in 2013 and an increase in prepaid ARPU to

$34.07 in 2014 from $31.44 in 2013, reflecting an increase in smartphone penetration and corresponding

revenues from data products and services, partially offset by lower monthly service billings for customers

on equipment installment plans. Billed ARPU in 2013 was relatively flat compared to $50.81 in 2012. An

increase in smartphone adoption and corresponding revenues from data products and services drove

higher ARPU; however, this growth was offset by the special issuance of loyalty rewards points in the

fourth quarter of 2013, which negatively impacted billed ARPU for the year by $0.70.

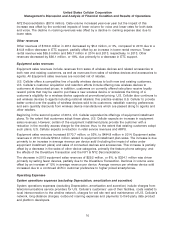

U.S. Cellular expects continued pressure on retail service revenues in the foreseeable future due to

industry competition for customers and related effects on pricing of service plan offerings offset to some

degree by continued adoption of smartphones and data usage. In addition, beginning in the second

quarter of 2014, U.S. Cellular expanded its offerings of equipment installment plans. To the extent that

customers adopt these plans, U.S. Cellular expects an increase in equipment sales revenues. However,

certain of the equipment installment plans provide the customer with a reduction in the monthly access

charge for the device; thus, to the extent that existing customers adopt such plans, U.S. Cellular expects

a reduction in retail service revenues and ARPU.

Inbound roaming revenues

Inbound roaming revenues decreased by $39.1 million, or 15% in 2014 to $224.1 million. The decrease

was due in part to a $17.6 million impact related to the Divestiture Transaction and NY1 &

NY2 Deconsolidation recorded in 2013. The remaining decrease in the Core Markets was due to a

decrease in rates and a decline in voice volume, partially offset by higher data usage. U.S. Cellular

expects modest growth in data volume, declining voice volumes and declining rates which likely will

result in declining inbound roaming revenues in the near term. Both inbound and outbound roaming

rates are subject to periodic revision; further, U.S. Cellular is negotiating 4G LTE roaming rates with

several carriers which could materially affect roamer revenues and expenses going forward.

Inbound roaming revenues decreased by $85.5 million, or 25% in 2013 to $263.2 million. The decrease

was due primarily to lower rates ($47.9 million) and the impacts of the Divestiture Transaction and NY1 &

9