US Cellular 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

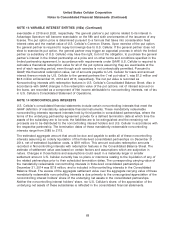

Notes to Consolidated Financial Statements (Continued)

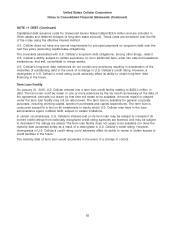

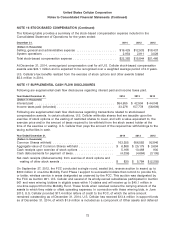

NOTE 11 DEBT (Continued)

Capitalized debt issuance costs for Unsecured Senior Notes totaled $25.9 million and are included in

Other assets and deferred charges (a long-term asset account). These costs are amortized over the life

of the notes using the effective interest method.

U.S. Cellular does not have any annual requirements for principal payments on long-term debt over the

next five years (excluding capital lease obligations).

The covenants associated with U.S. Cellular’s long-term debt obligations, among other things, restrict

U.S. Cellular’s ability, subject to certain exclusions, to incur additional liens, enter into sale and leaseback

transactions, and sell, consolidate or merge assets.

U.S. Cellular’s long-term debt indentures do not contain any provisions resulting in acceleration of the

maturities of outstanding debt in the event of a change in U.S. Cellular’s credit rating. However, a

downgrade in U.S. Cellular’s credit rating could adversely affect its ability to obtain long-term debt

financing in the future.

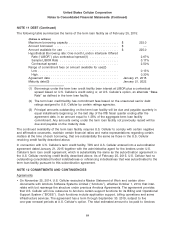

Term Loan Facility

On January 21, 2015, U.S. Cellular entered into a term loan credit facility relating to $225.0 million in

debt. The term loan must be drawn in one or more advances by the six month anniversary of the date of

the agreement; amounts not drawn by that time will cease to be available. Amounts repaid or prepaid

under the term loan facility may not be reborrowed. The term loan is available for general corporate

purposes, including working capital, spectrum purchases and capital expenditures. The term loan is

unsecured except for a lien on all investments in equity which U.S. Cellular may have in the loan

administrative agent, CoBank ACB, subject to certain limitations.

In certain circumstances, U.S. Cellular’s interest cost on its term loan may be subject to increase if its

current credit ratings from nationally recognized credit rating agencies are lowered, and may be subject

to decrease if the ratings are raised. The term loan facility does not cease to be available nor does the

maturity date accelerate solely as a result of a downgrade in U.S. Cellular’s credit rating. However,

downgrades in U.S. Cellular’s credit rating could adversely affect its ability to renew or obtain access to

credit facilities in the future.

The maturity date of term loan would accelerate in the event of a change in control.

63