US Cellular 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

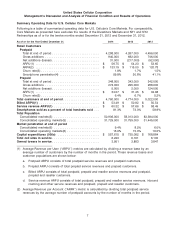

Management’s Discussion and Analysis of Financial Condition and Results of Operations

• Operating income (loss) decreased $290.3 million to a loss of $143.4 million in 2014 from income of

$146.9 million in 2013. The gain on license sales and exchanges and the gain on sale of business and

other exit costs contributed $145.8 million and $502.2 million to operating income in 2014 and 2013,

respectively. Without these items, operating income (loss) improved by $66.2 million due to higher

equipment revenue and lower selling, general and administrative, and depreciation, amortization and

accretion expenses, which were partially offset by lower service revenues and higher cost of

equipment sold.

• Net income (loss) attributable to U.S. Cellular shareholders decreased $182.9 million to a net loss of

$42.8 million in 2014 compared to net income of $140.0 million in 2013, due primarily to the net

impact of lower operating income, higher interest expense, and a decrease in gain on investments.

Basic earnings (loss) per share and Diluted earnings (loss) per share were $(0.51) in 2014, which was

$2.18 and $2.16 lower, respectively, than in 2013.

U.S. Cellular anticipates that its future results may be affected by the following factors:

• Effects of industry competition on service and equipment pricing;

• U.S. Cellular completed the migration of its customers to a new Billing and Operational Support

System (‘‘B/OSS’’) in the third quarter of 2013. Intermittent system outages and delayed system

response times negatively impacted customer service and sales operations at certain times. System

enhancements and other measures were implemented to address these issues, and customer service

and sales operations response times have improved to expected levels. In addition, in the fourth

quarter of 2014, U.S. Cellular entered into certain arrangements pursuant to which U.S. Cellular now

outsources certain support functions for its B/OSS to a third-party vendor. B/OSS is a complex system

and any future operational problems with the system, including any failure by the vendor to provide

the required level of service under the outsourcing arrangements, could have adverse effects on U.S.

Cellular’s results of operations or cash flows;

• Impacts of selling Apple products;

• Impacts of selling devices under equipment installment plans;

• Relative ability to attract and retain customers in a competitive marketplace in a cost effective manner;

• Expanded distribution of products and services in third-party national retailers;

• The nature and rate of growth in the wireless industry, requiring U.S. Cellular to grow revenues

primarily from selling additional products and services to its existing customers, increasing the number

of multi-device users among its existing customers, increasing data products and services and

attracting wireless customers switching from other wireless carriers;

• Continued growth in revenues and costs related to data products and services and declines in

revenues from voice services;

• Rapid growth in the demand for new data devices and services which may result in increased cost of

equipment sold and other operating expenses and the need for additional investment in spectrum,

network capacity and enhancements;

• Further consolidation among carriers in the wireless industry, which could result in increased

competition for customers and/or cause roaming revenues to decline;

• Uncertainty related to various rulemaking proceedings underway at the Federal Communications

Commission (‘‘FCC’’);

• The ability to negotiate satisfactory 4G LTE data roaming agreements with other wireless operators;

• In September 2014, U.S. Cellular entered into agreements to sell certain non-operating licenses

(‘‘unbuilt licenses’’) in exchange for receiving licenses in its operating markets and cash. These

3