US Cellular 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

NOTE 13 VARIABLE INTEREST ENTITIES (VIEs) (Continued)

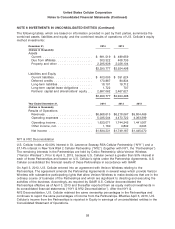

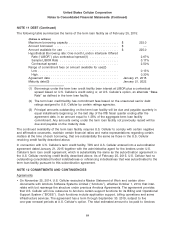

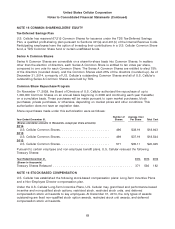

The following table presents the classification of the consolidated VIEs’ assets and liabilities in U.S.

Cellular’s Consolidated Balance Sheet.

December 31, 2014 2013

(Dollars in thousands)

Assets

Cash and cash equivalents .......................... $ 2,588 $ 2,076

Other current assets .............................. 278 1,184

Licenses ....................................... 312,977 310,475

Property, plant and equipment, net .................... 10,671 18,600

Other assets and deferred charges .................... 60,059 511

Total assets ..................................... $386,573 $332,846

Liabilities

Current liabilities ................................. $ 110 $ 46

Deferred liabilities and credits ........................ 622 3,139

Total liabilities ................................... $ 732 $ 3,185

Other Related Matters

An FCC auction of AWS-3 spectrum licenses, referred to as Auction 97, began in November 2014 and

ended in January 2015. U.S. Cellular participated in Auction 97 indirectly through its interest in

Advantage Spectrum. A subsidiary of U.S. Cellular is a limited partner in Advantage Spectrum.

Advantage Spectrum qualified as a ‘‘designated entity,’’ and thereby was eligible for bid credits with

respect to spectrum purchased in Auction 97. To participate in this auction, a $60.0 million deposit was

made to the FCC in 2014. Such amount is reflected in Other Assets and Deferred Charges in the

Consolidated Balance Sheet. Advantage Spectrum was the provisional winning bidder for 124 licenses

for an aggregate bid of $338.3 million, net of its anticipated designated entity discount of 25%.

Advantage Spectrum’s bid amount, less the initial deposit of $60.0 million, plus certain other charges

totaling $2.3 million, are required to be paid to the FCC by March 2, 2015.

Advantage Spectrum, Aquinas Wireless and King Street Wireless were formed to participate in

FCC auctions of wireless spectrum and to fund, establish, and provide wireless service with respect to

any FCC licenses won in the auctions. As such, these entities have risks similar to those described in the

‘‘Risk Factors’’ in U.S. Cellular’s Annual Report on Form 10-K.

U.S. Cellular’s capital contributions and advances made to its VIEs totaled $60.9 million in the year

ended December 31, 2014. In 2013, there were no capital contributions or advances made to VIEs or

their general partners that were not VIEs.

U.S. Cellular may agree to make additional capital contributions and/or advances to Advantage

Spectrum, Aquinas Wireless or King Street Wireless and/or to their general partners to provide additional

funding for the development of licenses granted in various auctions. U.S. Cellular may finance such

amounts with a combination of cash on hand, borrowings under its revolving credit agreement and/or

long-term debt. There is no assurance that U.S. Cellular will be able to obtain additional financing on

commercially reasonable terms or at all to provide such financial support.

The limited partnership agreements of Advantage Spectrum, Aquinas Wireless and King Street Wireless

also provide the general partner with a put option whereby the general partner may require the limited

partner, a subsidiary of U.S. Cellular, to purchase its interest in the limited partnership. The general

partner’s put options related to its interests in King Street Wireless and Aquinas Wireless will become

67