US Cellular 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

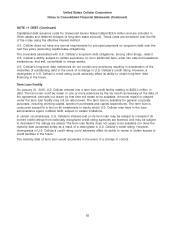

NOTE 13 VARIABLE INTEREST ENTITIES (VIEs) (Continued)

exercisable in 2019 and 2020, respectively. The general partner’s put options related to its interest in

Advantage Spectrum will become exercisable on the fifth and sixth anniversaries of the issuance of any

license. The put option price is determined pursuant to a formula that takes into consideration fixed

interest rates and the market value of U.S. Cellular’s Common Shares. Upon exercise of the put option,

the general partner is required to repay borrowings due to U.S. Cellular. If the general partner does not

elect to exercise its put option, the general partner may trigger an appraisal process in which the limited

partner (a subsidiary of U.S. Cellular) may have the right, but not the obligation, to purchase the general

partner’s interest in the limited partnership at a price and on other terms and conditions specified in the

limited partnership agreement. In accordance with requirements under GAAP, U.S. Cellular is required to

calculate a theoretical redemption value for all of the put options assuming they are exercisable at the

end of each reporting period, even though such exercise is not contractually permitted. Pursuant to

GAAP, this theoretical redemption value, net of amounts payable to U.S. Cellular for loans and accrued

interest thereon made by U.S. Cellular to the general partners the (‘‘net put value’’), was $1.2 million and

$0.5 million at December 31, 2014 and 2013, respectively. The net put value is recorded as

Noncontrolling interests with redemption features in U.S. Cellular’s Consolidated Balance Sheet. Also in

accordance with GAAP, changes in the redemption value of the put options, net of interest accrued on

the loans, are recorded as a component of Net income attributable to noncontrolling interests, net of tax,

in U.S. Cellular’s Consolidated Statement of Operations.

NOTE 14 NONCONTROLLING INTERESTS

U.S. Cellular’s consolidated financial statements include certain noncontrolling interests that meet the

GAAP definition of mandatorily redeemable financial instruments. These mandatorily redeemable

noncontrolling interests represent interests held by third parties in consolidated partnerships, where the

terms of the underlying partnership agreement provide for a defined termination date at which time the

assets of the subsidiary are to be sold, the liabilities are to be extinguished and the remaining net

proceeds are to be distributed to the noncontrolling interest holders and U.S. Cellular in accordance with

the respective partnership. The termination dates of these mandatorily redeemable noncontrolling

interests range from 2085 to 2113.

The estimated aggregate amount that would be due and payable to settle all of these noncontrolling

interests assuming an orderly liquidation of the finite-lived consolidated partnerships on December 31,

2014, net of estimated liquidation costs, is $9.9 million. This amount excludes redemption amounts

recorded in Noncontrolling interests with redemption features in the Consolidated Balance Sheet. The

estimate of settlement value was based on certain factors and assumptions which are subjective in

nature. Changes in those factors and assumptions could result in a materially larger or smaller

settlement amount. U.S. Cellular currently has no plans or intentions relating to the liquidation of any of

the related partnerships prior to their scheduled termination dates. The corresponding carrying value of

the mandatorily redeemable noncontrolling interests in finite-lived consolidated partnerships at

December 31, 2014 was $7.8 million, and is included in Noncontrolling interests in the Consolidated

Balance Sheet. The excess of the aggregate settlement value over the aggregate carrying value of these

mandatorily redeemable noncontrolling interests is due primarily to the unrecognized appreciation of the

noncontrolling interest holders’ share of the underlying net assets in the consolidated partnerships.

Neither the noncontrolling interest holders’ share, nor U.S. Cellular’s share, of the appreciation of the

underlying net assets of these subsidiaries is reflected in the consolidated financial statements.

68