US Cellular 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

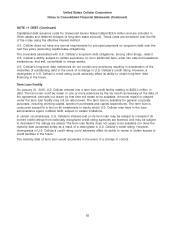

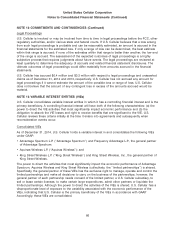

NOTE 11 DEBT (Continued)

consolidated funded indebtedness from U.S. Cellular to TDS will be unsecured and (b) any

(i) consolidated funded indebtedness from U.S. Cellular to TDS (other than ‘‘refinancing indebtedness’’

as defined in the subordination agreement) in excess of $105,000,000, and (ii) refinancing indebtedness

in excess of $250,000,000, will be subordinated and made junior in right of payment to the prior payment

in full of obligations to the lenders under U.S. Cellular’s revolving credit agreement. As of December 31,

2014, U.S. Cellular had no outstanding consolidated funded indebtedness or refinancing indebtedness

that was subordinated to the revolving credit agreement pursuant to the subordination agreement.

In July 2014, U.S. Cellular entered into an amendment to the revolving credit facility agreement which

increased the Consolidated Leverage Ratio (the ratio of Consolidated Funded Indebtedness to

Consolidated Earnings before interest, taxes, depreciation and amortization) that U.S. Cellular is required

to maintain. Beginning July 1, 2014, U.S. Cellular is required to maintain the Consolidated Leverage Ratio

at a level not to exceed 3.75 to 1.00 for the period of the four fiscal quarters most recently ended (this

was 3.00 to 1.00 prior to July 1, 2014). The terms of the amendment decrease the maximum permitted

Consolidated Leverage Ratio beginning January 1, 2016, with further decreases effective July 1, 2016

and January 1, 2017 (and will return to 3.00 to 1.00 at that time). For the twelve months ended

December 31, 2014, the actual Consolidated Leverage Ratio was 2.35 to 1.00. Future changes in U.S.

Cellular’s financial condition could negatively impact its ability to meet the financial covenants and

requirements in its revolving credit facility agreement.

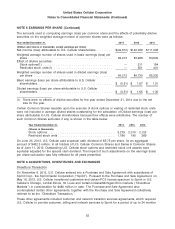

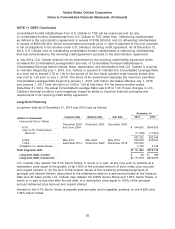

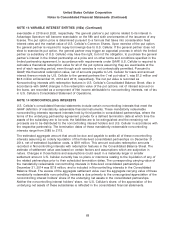

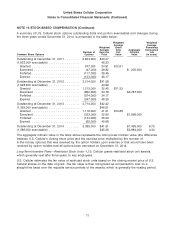

Long-Term Financing

Long-term debt as of December 31, 2014 and 2013 was as follows:

December 31,

Issuance date Maturity date Call date 2014 2013

(Dollars in thousands)

Unsecured Senior Notes

December 2003 December 2033 December 2003

6.7% .................. and June 2004 $ 544,000 $544,000

Less: 6.7% Unamortized

discount .............. (11,278) (11,551)

532,722 532,449

6.95% ................. May 2011 May 2060 May 2016 342,000 342,000

7.25% ................. December 2014 December 2063 December 2019 275,000 —

Obligation on capital leases . . . 2,143 3,749

Total long-term debt ......... $1,151,865 $878,198

Long-term debt, current ..... $ 46 $ 166

Long-term debt, noncurrent . . . $1,151,819 $878,032

U.S. Cellular may redeem the 6.7% Senior Notes, in whole or in part, at any time prior to maturity at a

redemption price equal to the greater of (a) 100% of the principal amount of such notes, plus accrued

and unpaid interest, or (b) the sum of the present values of the remaining scheduled payments of

principal and interest thereon discounted to the redemption date on a semi-annual basis at the Treasury

Rate plus 30 basis points. U.S. Cellular may redeem the 6.95% Senior Notes and 7.25% Senior Notes, in

whole or in part at any time after the call date, at a redemption price equal to 100% of the principal

amount redeemed plus accrued and unpaid interest.

Interest on the 6.7% Senior Notes is payable semi-annually, and is payable quarterly on the 6.95% and

7.25% Senior Notes.

62