US Cellular 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

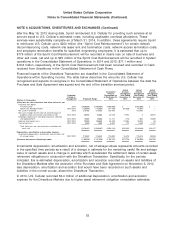

Defined Contribution Plans

U.S. Cellular participates in a qualified noncontributory defined contribution pension plan sponsored by

TDS; such plan provides pension benefits for the employees of U.S. Cellular and its subsidiaries. Under

this plan, pension benefits and costs are calculated separately for each participant and are funded

currently. Pension costs were $10.6 million, $10.4 million and $12.4 million in 2014, 2013 and 2012,

respectively.

U.S. Cellular also participates in a defined contribution retirement savings plan (‘‘401(k) plan’’) sponsored

by TDS. Total costs incurred for U.S. Cellular’s contributions to the 401(k) plan were $14.9 million,

$15.4 million and $17.1 million in 2014, 2013 and 2012, respectively.

Recently Issued Accounting Pronouncements

On April 10, 2014, the FASB issued Accounting Standards Update 2014-08, Reporting Discontinued

Operations and Disclosures of Disposals of Components of an Entity (‘‘ASU 2014-08’’). ASU 2014-08

changes the requirements and disclosures for reporting discontinued operations. U.S. Cellular was

required to adopt the provisions of ASU 2014-08 effective January 1, 2015, but early adoption was

permitted. U.S. Cellular adopted the provisions of ASU 2014-08 upon its issuance. The adoption of ASU

2014-08 did not have a significant impact on U.S. Cellular’s financial position or results of operations.

On May 28, 2014, the FASB issued Accounting Standards Update 2014-09, Revenue from Contracts with

Customers (‘‘ASU 2014-09’’). ASU 2014-09 outlines a single comprehensive model to use in accounting

for revenue arising from contracts with customers. U.S. Cellular is required to adopt the provisions of

ASU 2014-09 effective January 1, 2017. Early adoption is prohibited. U.S. Cellular is evaluating what

effects the adoption of ASU 2014-09 will have on U.S. Cellular’s financial position and results of

operations.

On August 27, 2014, the FASB issued Accounting Standards Update 2014-15, Disclosure of Uncertainties

about an Entity’s Ability to Continue as a Going Concern (‘‘ASU 2014-15’’). ASU 2014-15 requires

management to perform interim and annual assessments of an entity’s ability to continue as a going

concern within one year of the date financial statements are issued and provides guidance on

determining when and how to disclose going concern uncertainties in financial statements. U.S. Cellular

is required to adopt the provisions of ASU 2014-15 effective January 1, 2016, but early adoption is

permitted. The adoption of ASU 2014-15 is not expected to impact U.S. Cellular’s financial position or

results of operations.

On January 9, 2015, the FASB issued Accounting Standards Update 2015-01, Simplifying Income

Statement Presentation by Eliminating the Concept of Extraordinary Items (‘‘ASU 2015-01’’). ASU 2015-01

eliminates from GAAP the requirement to separately classify, present and disclose extraordinary events

and transactions. U.S. Cellular is required to adopt the provisions of ASU 2015-01 effective January 1,

2016, but early adoption is permitted. The adoption of ASU 2015-01 is not expected to impact U.S.

Cellular’s financial position or results of operations.

On February 18, 2015, the FASB issued Accounting Standards Update 2015-02, Consolidation:

Amendments to the Consolidation Analysis (‘‘ASU 2015-02’’). ASU 2015-02 simplifies consolidation

accounting by reducing the number of consolidation models and changing various aspects of current

GAAP, including certain consolidation criteria for variable interest entities. U.S. Cellular is required to

adopt the provisions of ASU 2015-02 effective January 1, 2016. Early adoption is permitted. U.S. Cellular

is still assessing the impact, if any, the adoption of ASU 2015-02 will have on U.S. Cellular’s financial

position or results of operations.

46