US Cellular 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

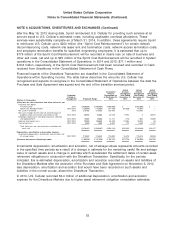

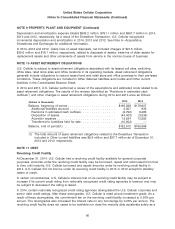

NOTE 6 ACQUISITIONS, DIVESTITURES AND EXCHANGES (Continued)

• In September 2014, U.S. Cellular entered into an agreement with a third party to exchange certain PCS

and AWS licenses for certain other PCS and AWS licenses and $28.0 million of cash. This license

exchange will be accomplished in two closing transactions. The first closing occurred in December

2014 at which time U.S. Cellular received licenses with an estimated fair value, per a market approach,

of $51.5 million, recorded a $21.7 million gain in (Gain) loss on license sales and exchanges in the

Consolidated Statement of Operations and recorded an $18.3 million deferred credit in Other current

liabilities. The second closing is expected to occur in 2015. The license that will be transferred has

been classified as ‘‘Assets held for sale’’ in the Consolidated Balance Sheet as of December 31, 2014.

At the time of the second closing, U.S. Cellular will recognize the deferred credit from the first closing

and expects to record a gain on the license exchange.

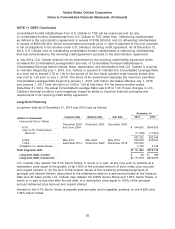

• In September 2014, U.S. Cellular entered into an agreement with a third party to exchange certain of

its PCS unbuilt licenses for PCS licenses located in U.S. Cellular’s operating markets plus

$117.0 million of cash. This transaction is subject to regulatory approvals and is expected to close in

2015. The book value of the licenses to be exchanged have been classified as ‘‘Assets held for sale’’

in the Consolidated Balance Sheet at December 31, 2014. U.S. Cellular expects to record a gain when

this transaction closes.

• In May 2014, U.S. Cellular entered into a License Purchase and Customer Recommendation

Agreement with Airadigm Communications, Inc. (‘‘Airadigm’’). TDS owns 100% of the common stock of

Airadigm. Pursuant to the License Purchase and Customer Recommendation Agreement, on

September 10, 2014, Airadigm transferred to U.S. Cellular Federal Communications Commission

(‘‘FCC’’) spectrum licenses and certain tower assets in certain markets in Wisconsin, Iowa, Minnesota

and Michigan, in consideration for $91.5 million in cash. Since both parties to this transaction are

controlled by TDS, upon closing, U.S. Cellular recorded the transferred assets at Airadigm’s net book

value of $15.2 million. The difference between the consideration paid and the net book value of the

transferred assets was recorded as a reduction of U.S. Cellular’s Retained earnings. In addition, a

deferred tax asset was recorded for the difference between the consideration paid and the net book

value of the transferred assets, which increased U.S. Cellular’s Additional paid-in capital.

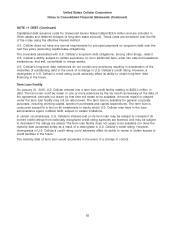

• In March 2014, U.S. Cellular sold the majority of its St. Louis area non-operating market spectrum

license for $92.3 million. A gain of $75.8 million was recorded in (Gain) loss on license sales and

exchanges in the Consolidated Statement of Operations in the first quarter of 2014.

• In February 2014, U.S. Cellular completed an exchange whereby U.S. Cellular received one E block

PCS spectrum license covering Milwaukee, WI in exchange for one D block PCS spectrum license

covering Milwaukee, WI. The exchange of licenses provided U.S. Cellular with spectrum to meet

anticipated future capacity and coverage requirements. No cash, customers, network assets, other

assets or liabilities were included in the exchange. As a result of this transaction, U.S. Cellular

recognized a gain of $15.7 million, representing the difference between the $15.9 million fair value of

the license surrendered, calculated using a market approach valuation method, and the $0.2 million

carrying value of the license surrendered. This gain was recorded in (Gain) loss on license sales and

exchanges in the Consolidated Statement of Operations in the first quarter of 2014.

• In October 2013, U.S. Cellular sold the majority of its Mississippi Valley non-operating market license

(‘‘unbuilt license’’) for $308.0 million. At the time of the sale, a $250.6 million gain was recorded in

(Gain) loss on license sales and exchanges in the Consolidated Statement of Operations.

• In November 2012, U.S. Cellular acquired seven 700 MHz licenses covering portions of Illinois,

Michigan, Minnesota, Missouri, Nebraska, Oregon, Washington and Wisconsin for $57.7 million.

• In August 2012, U.S. Cellular acquired four 700 MHz licenses covering portions of Iowa, Kansas,

Missouri, Nebraska and Oklahoma for $34.0 million.

55