US Cellular 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

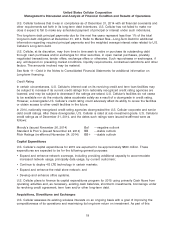

amount of cash generated by business operations (including cash proceeds from the Sprint Cost

Reimbursement), after Cash used for additions to property, plant and equipment.

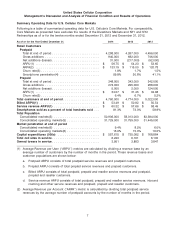

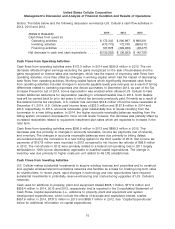

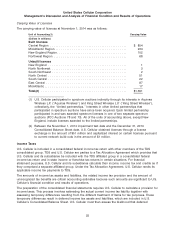

2014 2013 2012

(Dollars in thousands)

Cash flows from operating activities ........... $172,342 $ 290,897 $899,291

Add: Sprint Cost Reimbursement(1) ........... 71,097 10,560 —

Less: Cash used for additions to property, plant

and equipment ......................... 605,083 717,862 826,400

Adjusted free cash flow ................... $(361,644) $(416,405) $ 72,891

(1) See Note 6—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated

Financial Statements for additional information related to the Sprint Cost Reimbursement.

See Cash flows from Operating Activities and Cash flows from Investing Activities for additional

information related to the components of Adjusted free cash flow.

LIQUIDITY

U.S. Cellular believes that existing cash and investment balances, funds available under its revolving

credit facility and term loan facility and expected cash flows from operating and investing activities

provide substantial liquidity and financial flexibility for U.S. Cellular to meet its normal day-to-day

operating needs. However, these resources may not be adequate to fund all future expenditures that the

company could potentially elect to make such as acquisitions of spectrum licenses in FCC auctions and

other acquisition, construction and development programs. It may be necessary from time to time to

increase the size of the existing revolving credit facility, to put in place new facilities, or to obtain other

forms of financing in order to fund these potential expenditures. To the extent that sufficient funds are not

available to U.S. Cellular or its subsidiaries on terms or at prices acceptable to U.S. Cellular, it could

require U.S. Cellular to reduce its acquisition, construction and development programs.

U.S. Cellular’s profitability historically has been lower in the fourth quarter as a result of significant

marketing and promotional activities during the holiday season. Additionally, U.S. Cellular expects lower

cash flows from operating activities in the near term as the popularity of its equipment installment plans

increases. U.S. Cellular cannot provide assurances that circumstances that could have a material adverse

effect on its liquidity or capital resources will not occur. Economic conditions, changes in financial

markets, U.S. Cellular financial performance and/or prospects or other factors could restrict U.S.

Cellular’s liquidity and availability of financing on terms and prices acceptable to U.S. Cellular, which

could require U.S. Cellular to reduce its capital expenditure, acquisition or share repurchase programs.

Such reductions could have a material adverse effect on U.S. Cellular’s business, financial condition or

results of operations.

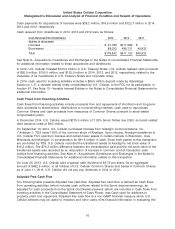

Cash and Cash Equivalents

At December 31, 2014, U.S. Cellular’s cash and cash equivalents totaled $211.5 million. Cash and cash

equivalents include cash and short-term, highly liquid investments with original maturities of three months

or less. The primary objective of U.S. Cellular’s Cash and cash equivalents investment activities is to

preserve principal. At December 31, 2014, the majority of U.S. Cellular’s Cash and cash equivalents was

held in bank deposit accounts and in money market funds that invest exclusively in U.S. Treasury Notes

or in repurchase agreements fully collateralized by such obligations. U.S. Cellular monitors the financial

viability of the money market funds and direct investments in which it invests and believes that the credit

risk associated with these investments is low.

17