US Cellular 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

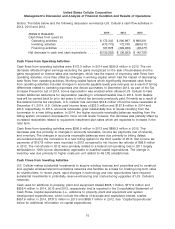

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

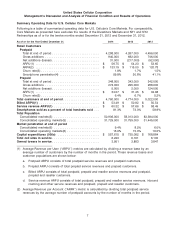

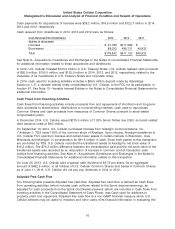

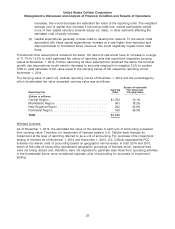

Components of Other Income (Expense)

Increase/ Percentage Increase/ Percentage

Year Ended December 31, 2014 (Decrease) Change 2013 (Decrease) Change 2012

(Dollars in thousands)

Operating income (loss) ....... $(143,390) $(290,255) >(100)% $146,865 $ (9,791) (6)% $156,656

Equity in earnings of

unconsolidated entities ...... 129,764 (2,185) (2)% 131,949 41,585 46% 90,364

Interest and dividend income . . . 12,148 8,187 >100% 3,961 317 9% 3,644

Gain (loss) on investments ..... — (18,556) N/M 18,556 22,274 >100% (3,718)

Interest expense ............ (57,386) 13,423 31% (43,963) 1,570 4% (42,393)

Other, net ................. 160 (128) (44)% 288 (212) (42)% 500

Total investment and other

income ................. 84,686 (26,105) (24)% 110,791 62,394 >100% 48,397

Income (loss) before income

taxes .................. (58,704) (316,360) >(100)% 257,656 52,603 26% 205,053

Income tax expense (benefit) . . . (11,782) (124,916) >(100)% 113,134 49,157 77% 63,977

Net income (loss) ........... (46,922) (191,444) >(100)% 144,522 3,446 2% 141,076

Less: Net income (loss)

attributable to noncontrolling

interests, net of tax ......... (4,110) (8,594) >(100)% 4,484 (25,586) (85)% 30,070

Net income (loss) attributable to

U.S. Cellular shareholders . . . . $ (42,812) $(182,850) >(100)% $140,038 $ 29,032 26% $111,006

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents U.S. Cellular’s share of net income from entities

in which it has a noncontrolling interest and that are accounted for by the equity method.

U.S. Cellular’s investment in the Los Angeles SMSA Limited Partnership (‘‘LA Partnership’’) contributed

$71.8 million, $78.4 million and $67.2 million to Equity in earnings of unconsolidated entities in 2014,

2013 and 2012, respectively.

On April 3, 2013, U.S. Cellular deconsolidated the NY1 & NY2 Partnerships and began reporting them as

equity method investments in its consolidated financial statements as of that date. Equity in earnings of

the NY1 & NY2 Partnerships was $29.0 million and $24.7 million in 2014 and 2013, respectively. See

Note 8—Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for

additional information.

Interest and dividend income

In 2014, Interest and dividend income increased by $8.2 million due primarily to imputed interest income

recognized on equipment installment plans. See Note 3—Equipment Installment Plans in the Notes to

Consolidated Financial Statements for additional information.

Gain (loss) on investments

In 2013, in connection with the deconsolidation of the NY1 & NY2 Partnerships, U.S. Cellular recognized

a non-cash pre-tax gain of $18.5 million.

Interest expense

In 2014, interest expense increased by $13.4 million from 2013 due primarily to a decrease in capitalized

interest related to network and systems projects. Interest cost capitalized was $6.2 million and

$18.4 million for 2014 and 2013, respectively. Interest expense in 2013 as compared to 2012 was

relatively flat.

13