US Cellular 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cash payments for acquisitions of licenses were $38.2 million, $16.5 million and $122.7 million in 2014,

2013 and 2012, respectively.

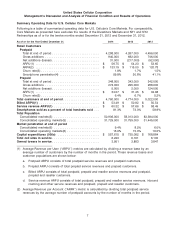

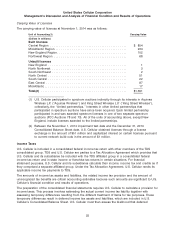

Cash received from divestitures in 2014, 2013 and 2012 were as follows:

Cash Received from Divestitures 2014 2013 2012

(Dollars in thousands)

Licenses ................................. $ 91,789 $311,989 $ —

Businesses ............................... 88,053 499,131 49,932

Total .................................... $179,842 $811,120 $49,932

See Note 6—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements

for additional information related to these acquisitions and divestitures.

In 2012, U.S. Cellular invested $120.0 million in U.S. Treasury Notes. U.S. Cellular realized cash proceeds

of $50.0 million, $100.0 million, and $125.0 million in 2014, 2013, and 2012, respectively, related to the

maturities of its investments in U.S. Treasury Notes and corporate notes.

In 2014, cash used for investing activities includes a $60.0 million deposit made by Advantage

Spectrum, L.P., a variable interest entity consolidated by U.S. Cellular, to the FCC for its participation in

Auction 97. See Note 13—Variable Interest Entities in the Notes to Consolidated Financial Statements for

additional information.

Cash Flows from Financing Activities

Cash flows from financing activities include proceeds from and repayments of short-term and long-term

debt, dividends to shareholders, distributions to noncontrolling interests, cash used to repurchase

Common Shares and cash proceeds from reissuance of Common Shares pursuant to stock-based

compensation plans.

In December 2014, U.S. Cellular issued $275.0 million of 7.25% Senior Notes due 2063, and paid related

debt issuance costs of $9.2 million.

On September 10, 2014, U.S. Cellular purchased licenses from Airadigm Communications, Inc.

(‘‘Airadigm’’). TDS owns 100% of the common stock of Airadigm. Upon closing, Airadigm transferred to

U.S. Cellular FCC spectrum licenses and certain tower assets in certain markets in Wisconsin, Iowa,

Minnesota and Michigan, in consideration for $91.5 million in cash. Since both parties to this transaction

are controlled by TDS, U.S. Cellular recorded the transferred assets at Airadigm’s net book value of

$15.2 million. The $76.3 million difference between the consideration paid and the net book value of the

transferred assets was recorded as an Acquisition of licenses in common control transaction cash

outflow from financing activities. See Note 6—Acquisitions, Divestitures and Exchanges in the Notes to

Consolidated Financial Statements for additional information related to this transaction.

On June 25, 2013, U.S. Cellular paid a special cash dividend of $5.75 per share, for an aggregate

amount of $482.3 million, to all holders of U.S. Cellular Common Shares and Series A Common Shares

as of June 11, 2013. U.S. Cellular did not pay any dividends in 2014 or 2012.

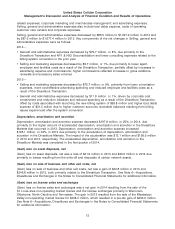

Adjusted Free Cash Flow

The following table presents Adjusted free cash flow. Adjusted free cash flow is defined as Cash flows

from operating activities (which includes cash outflows related to the Sprint decommissioning), as

adjusted for cash proceeds from the Sprint Cost Reimbursement (which are included in Cash flows from

investing activities in the Consolidated Statement of Cash Flows), less Cash used for additions to

property, plant and equipment. Adjusted free cash flow is a non-GAAP financial measure which U.S.

Cellular believes may be useful to investors and other users of its financial information in evaluating the

16