US Cellular 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

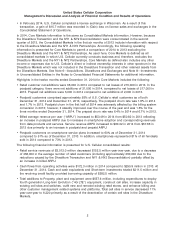

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(3) Churn metrics represent the percentage of the postpaid or prepaid customers that disconnects

service each month. These metrics represent the average monthly postpaid or prepaid churn rate for

each respective period.

(4) Smartphones represent wireless devices which run on an Android, Apple, BlackBerry or Windows

Mobile operating system, excluding connected devices. Smartphone penetration is calculated by

dividing postpaid smartphone customers by total postpaid customers.

(5) The decrease in the population of consolidated markets is due primarily to the divestiture of the

Mississippi Valley non-operating license in October 2013, the majority of the St. Louis area

non-operating market license in March 2014, and certain non-operating licenses in North Carolina in

December 2014. Total Population is used only to calculate market penetration of consolidated

markets and consolidated operating markets, respectively. See footnote (6) below.

(6) Market penetration is calculated by dividing the number of wireless customers at the end of the

period by the total population of consolidated markets and consolidated operating markets,

respectively, as estimated by Claritas. The increase in consolidated markets penetration is due

primarily to a lower denominator as a result of the license divestitures described in footnote

(5) above.

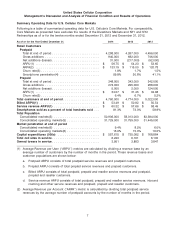

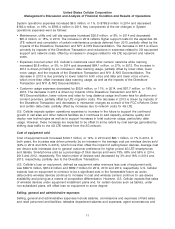

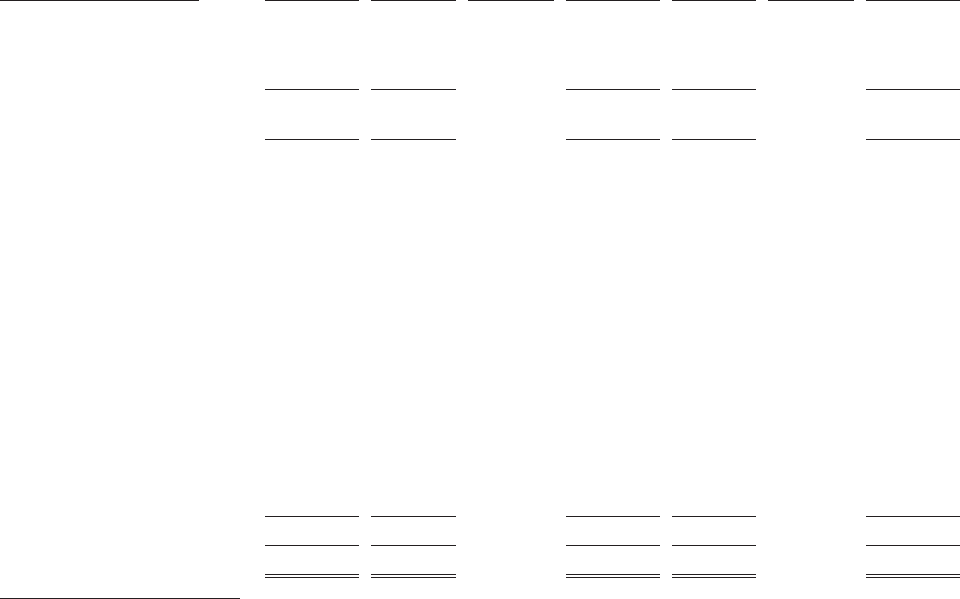

Components of Operating Income (Loss)

Increase/ Percentage Increase/ Percentage

Year Ended December 31, 2014 (Decrease) Change 2013 (Decrease) Change 2012

(Dollars in thousands)

Retail service ........... $3,012,984 $(152,512) (5)% $3,165,496 $(382,483) (11)% $3,547,979

Inbound roaming ........ 224,090 (39,096) (15)% 263,186 (85,531) (25)% 348,717

Other ................. 160,863 (5,228) (3)% 166,091 (36,069) (18)% 202,160

Service revenues ....... 3,397,937 (196,836) (5)% 3,594,773 (504,083) (12)% 4,098,856

Equipment sales ......... 494,810 170,747 53% 324,063 (29,165) (8)% 353,228

Total operating revenues . . 3,892,747 (26,089) (1)% 3,918,836 (533,248) (12)% 4,452,084

System operations

(excluding Depreciation,

amortization and accretion

reported below) ........ 769,911 6,476 1% 763,435 (183,370) (19)% 946,805

Cost of equipment sold .... 1,192,669 193,669 19% 999,000 63,053 7% 935,947

Selling, general and

administrative ......... 1,591,914 (85,481) (5)% 1,677,395 (87,538) (5)% 1,764,933

Depreciation, amortization

and accretion ......... 605,997 (197,784) (25)% 803,781 195,148 32% 608,633

(Gain) loss on asset

disposals, net ......... 21,469 9,137 30% 30,606 (12,518) (69)% 18,088

(Gain) loss on sale of

business and other exit

costs, net ............ (32,830) (213,937) (87)% (246,767) 267,789 >100% 21,022

(Gain) loss on license sales

and exchanges ........ (112,993) (142,486) (56)% (255,479) 255,479 N/M —

Total operating expenses . 4,036,137 264,166 7% 3,771,971 (523,457) (12)% 4,295,428

Operating income (loss) .... $(143,390) $(290,255) >(100)% $ 146,865 $ (9,791) (6)% $ 156,656

N/M—Percentage change not meaningful

8