US Cellular 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

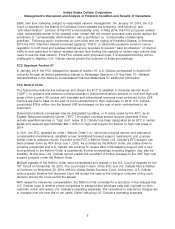

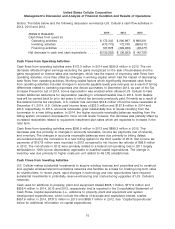

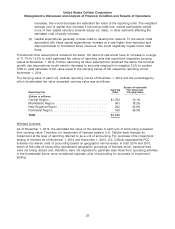

factors. The table below and the following discussion summarize U.S. Cellular’s cash flow activities in

2014, 2013 and 2012.

2014 2013 2012

(Dollars in thousands)

Cash flows from (used in)

Operating activities ..................... $172,342 $ 290,897 $ 899,291

Investing activities ...................... (470,772) 172,749 (896,611)

Financing activities ..................... 167,878 (499,939) (48,477)

Net decrease in cash and cash equivalents ..... $(130,552) $ (36,293) $ (45,797)

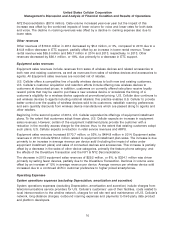

Cash Flows from Operating Activities

Cash flows from operating activities were $172.3 million in 2014 and $290.9 million in 2013. The net

decrease reflected higher earnings excluding the gains recognized on the sale of businesses and the

gains recognized on license sales and exchanges, which had the impact of improving cash flows from

operating activities, more than offset by changes in working capital, which had the impact of decreasing

cash flows from operating activities. Working capital factors which significantly decreased cash flows

from operating activities included changes in accounts payable levels year-over-year as a result of timing

differences related to operating expenses and device purchases. In December 2014, as part of the Tax

Increase Prevention act of 2014, bonus depreciation was enacted which allowed U.S. Cellular to take

certain additional deductions for depreciation resulting in a federal taxable loss in 2014. Such taxable

loss will be carried back to prior tax years to refund tax amounts previously paid. Primarily as a result of

this federal income tax carryback, U.S. Cellular has recorded $74.8 million of Income taxes receivable at

December 31, 2014. U.S. Cellular paid income taxes of $33.3 million and $157.8 million in 2014 and

2013, respectively. In 2013, accounts receivable grew substantially due to issues resulting from the

conversion to a new billing system. In 2014, the higher accounts receivable balances resulting from the

billing system conversion decreased to more normal levels; however, this decrease was partially offset by

increased receivables related to equipment installment plan sales which are expected to increase in the

near term.

Cash flows from operating activities were $290.9 million in 2013 and $899.3 million in 2012. This

decrease was due primarily to changes in accounts receivable, income tax payments (net of refunds),

and inventory. The changes in accounts receivable balances were due primarily to billing delays

encountered during the conversion to a new billing system in the third quarter of 2013. Net income tax

payments of $157.8 million were recorded in 2013 compared to net income tax refunds of $58.6 million

in 2012. The net refunds in 2012 were primarily related to a federal net operating loss in 2011 largely

attributable to 100% bonus depreciation applicable to qualified capital expenditures. The change in

inventory was due primarily to higher costs per unit related to 4G LTE smartphones.

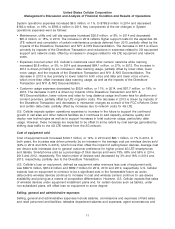

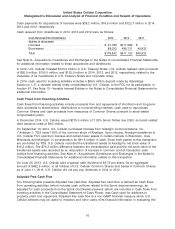

Cash Flows from Investing Activities

U.S. Cellular makes substantial investments to acquire wireless licenses and properties and to construct

and upgrade wireless telecommunications networks and facilities as a basis for creating long-term value

for shareholders. In recent years, rapid changes in technology and new opportunities have required

substantial investments in potentially revenue-enhancing and cost-reducing upgrades of U.S. Cellular’s

networks.

Cash used for additions to property, plant and equipment totaled $605.1 million, $717.9 million and

$826.4 million in 2014, 2013 and 2012, respectively, and is reported in the Consolidated Statement of

Cash Flows. Capital expenditures (i.e., additions to property, plant and equipment and system

development expenditures), which include the effects of accruals and capitalized interest, totaled

$557.6 million in 2014, $737.5 million in 2013 and $836.7 million in 2012. See ‘‘Capital Expenditures’’

below for additional information on capital expenditures.

15