US Cellular 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

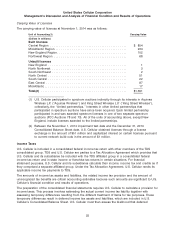

strategy, U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets

and wireless spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for

other wireless interests those interests that are not strategic to its long-term success. As a result, U.S.

Cellular may be engaged from time to time in negotiations relating to the acquisition, divestiture or

exchange of companies, properties or wireless spectrum. In general, U.S. Cellular may not disclose such

transactions until there is a definitive agreement. See Note 6—Acquisitions, Divestitures and Exchanges

in the Notes to Consolidated Financial Statements for additional information related to significant

transactions, including expected pre-tax cash proceeds from such transactions in 2015.

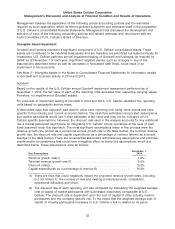

Variable Interest Entities

U.S. Cellular consolidates certain entities because they are ‘‘variable interest entities’’ under accounting

principles generally accepted in the United States of America (‘‘GAAP’’). See Note 13—Variable Interest

Entities in the Notes to Consolidated Financial Statements for additional information related to these

variable interest entities. U.S. Cellular may elect to make additional capital contributions and/or advances

to these variable interest entities in future periods in order to fund their operations.

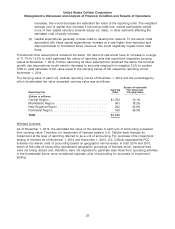

FCC Spectrum Auction 97

In January 2015, the FCC released the results of Auction 97. U.S. Cellular participated in Auction 97

indirectly through its limited partnership interest in Advantage Spectrum. Advantage Spectrum was the

provisional winning bidder of 124 licenses for an aggregate bid of $338.3 million, net of its anticipated

designated entity discount of 25%. On or prior to March 2, 2015, Advantage Spectrum is required to pay

the FCC for its bid amount, less the initial deposit of $60.0 million, plus certain other charges totaling

$2.3 million. Advantage Spectrum expects to fund this capital requirement with loans and contributions

made by U.S. Cellular. U.S. Cellular plans to use a portion of the proceeds received from the issuance of

its 7.25% Senior Notes and term loan facility to provide these loans and contributions to Advantage

Spectrum.

Common Share Repurchase Program

In the past year, U.S. Cellular has repurchased and expects to continue to repurchase its Common

Shares, subject to its repurchase program. For additional information related to the current repurchase

authorization and repurchases made during 2014, 2013 and 2012, see Note 15—Common Shareholders’

Equity in the Notes to Consolidated Financial Statements and Part II, Item 2. Unregistered Sales of Equity

Securities and Use of Proceeds.

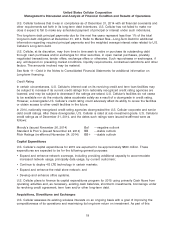

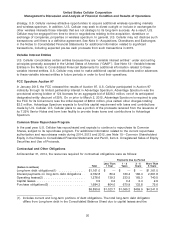

Contractual and Other Obligations

At December 31, 2014, the resources required for contractual obligations were as follows:

Payments Due by Period

Less Than 1 - 3 3 - 5 More Than

Total 1 Year Years Years 5 Years

(Dollars in millions)

Long-term debt obligations(1) ............... $1,161.0 $ — $ — $ — $1,161.0

Interest payments on long-term debt obligations . . 2,762.8 80.2 160.4 160.4 2,361.8

Operating leases(2) ....................... 1,278.6 139.3 233.5 165.3 740.5

Capital leases ........................... 3.9 0.2 0.4 0.4 2.9

Purchase obligations(3) .................... 1,684.3 804.0 670.9 133.8 75.6

$6,890.6 $1,023.7 $1,065.2 $459.9 $4,341.8

(1) Includes current and long-term portions of debt obligations. The total long-term debt obligation

differs from Long-term debt in the Consolidated Balance Sheet due to capital leases and the

20