US Cellular 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

NOTE 11 DEBT (Continued)

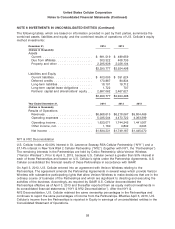

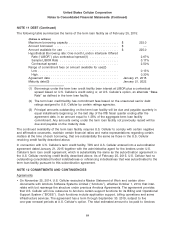

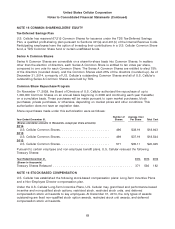

The following table summarizes the terms of the term loan facility as of February 25, 2015:

(Dollars in millions)

Maximum borrowing capacity ........................... $ 225.0

Amount borrowed ................................... $ —

Amount available for use .............................. $ 225.0

Hypothetical Borrowing rate: One-month London Interbank Offered

Rate (‘‘LIBOR’’) plus contractual spread(1) ................ 2.67%

Sample LIBOR Rate ................................ 0.17%

Contractual spread ................................. 2.50%

Range of commitment fees on amount available for use(2)

Low............................................ 0.13%

High ............................................ 0.30%

Agreement date ..................................... January 21, 2015

Maturity date(3) ..................................... January 21, 2022

(1) Borrowings under the term loan credit facility bear interest at LIBOR plus a contractual

spread based on U.S. Cellular’s credit rating or, at U.S. Cellular’s option, an alternate ‘‘Base

Rate’’ as defined in the term loan facility.

(2) The term loan credit facility has commitment fees based on the unsecured senior debt

ratings assigned to U.S. Cellular by certain ratings agencies.

(3) Principal amounts outstanding on the term loan facility will be due and payable quarterly in

equal installments beginning on the last day of the fifth fiscal quarter ending after the

agreement date, in an amount equal to 1.25% of the aggregate term loan facility

commitment. Any amounts owing under the term loan facility not previously repaid will be

due and payable on the maturity date.

The continued availability of the term loan facility requires U.S. Cellular to comply with certain negative

and affirmative covenants, maintain certain financial ratios and make representations regarding certain

matters at the time of each borrowing, that are substantially the same as those in the U.S. Cellular

revolving credit facility described above.

In connection with U.S. Cellular’s term credit facility, TDS and U.S. Cellular entered into a subordination

agreement dated January 21, 2015 together with the administrative agent for the lenders under U.S.

Cellular’s term loan credit agreement, which is substantially the same as the subordination agreement in

the U.S. Cellular revolving credit facility described above. As of February 25, 2015, U.S. Cellular had no

outstanding consolidated funded indebtedness or refinancing indebtedness that was subordinated to the

term loan facility pursuant to this subordination agreement.

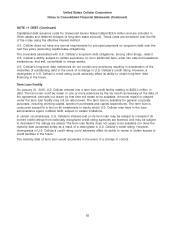

NOTE 12 COMMITMENTS AND CONTINGENCIES

Agreements

• On November 25, 2014, U.S. Cellular executed a Master Statement of Work and certain other

documents with Amdocs Software Systems Limited (‘‘Amdocs’’), effective October 1, 2014, that inter-

relate with but rearrange the structure under previous Amdocs Agreements. The agreement provides

that U.S. Cellular will now outsource to Amdocs certain support functions for its Billing and Operational

Support System (‘‘B/OSS’’). Such functions include application support, billing operations and some

infrastructure services. The agreement has a term through September 30, 2019, subject to five

one-year renewal periods at U.S. Cellular’s option. The total estimated amount to be paid to Amdocs

64