US Cellular 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

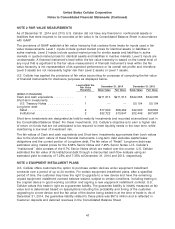

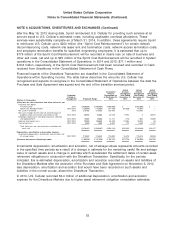

NOTE 4 INCOME TAXES (Continued)

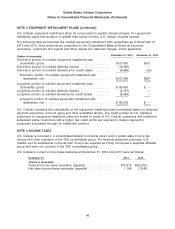

Income tax expense (benefit) is summarized as follows:

Year Ended December 31, 2014 2013 2012

(Dollars in thousands)

Current

Federal ................................. $(77,931) $180,056 $10,547

State .................................. 8,545 8,426 4,186

Deferred

Federal ................................. 44,881 (69,917) 54,490

State .................................. 6,276 (5,431) (5,246)

State—valuation allowance adjustment .......... 6,447 — —

$(11,782) $113,134 $63,977

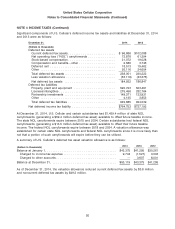

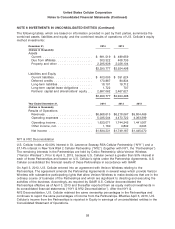

A reconciliation of U.S. Cellular’s income tax expense computed at the statutory rate to the reported

income tax expense, and the statutory federal income tax expense rate to U.S. Cellular’s effective income

tax expense rate is as follows:

2014 2013 2012

Year Ended December 31, Amount Rate Amount Rate Amount Rate

(Dollars in millions)

Statutory federal income tax expense and rate ........ $(20.5) 35.0% $ 90.2 35.0% $71.8 35.0%

State income taxes, net of federal benefit(1) ......... 12.2 (20.8) 5.2 2.0 3.7 1.8

Effect of noncontrolling interests .................. (5.8) 9.8 (2.2) (0.9) (6.3) (3.1)

Gains (losses) on investments and sale of assets(2) . . . — — 20.5 8.0 — —

Correction of deferred taxes(3) ................... — — — — (5.3) (2.6)

Other differences, net ......................... 2.3 (3.9) (0.6) (0.2) 0.1 0.1

Total income tax expense and rate ................ $(11.8) 20.1% $113.1 43.9% $64.0 31.2%

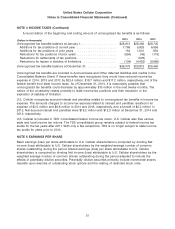

(1) State income taxes, net of federal benefit, include changes in unrecognized tax benefits as well as

adjustments to the valuation allowance. During the third quarter of 2014 U.S. Cellular recorded a

$6.4 million increase to income tax expense related to a valuation allowance recorded against

certain state deferred tax assets. In each interim period, U.S. Cellular evaluates the available positive

and negative evidence to assess whether deferred tax assets are realizable, on a more likely than

not basis. During the year ended December 31, 2014, based on revised forecasts of future state

income, U.S. Cellular concluded that the negative evidence related to the realization of certain state

deferred tax assets outweighed the positive evidence. Accordingly, U.S. Cellular determined that

such deferred tax assets related to certain states were not realizable, on a more likely than not

basis.

(2) Gains (losses) on investments and sale of assets represents 2013 tax expense related to the NY1 &

NY2 Deconsolidation and the Divestiture Transaction.

(3) Correction of deferred taxes reflects immaterial adjustments to correct deferred tax balances in 2012

related to tax basis and law changes that related to periods prior to 2012.

49