US Cellular 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

NOTE 8 INVESTMENTS IN UNCONSOLIDATED ENTITIES (Continued)

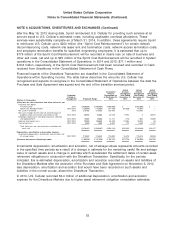

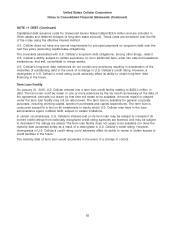

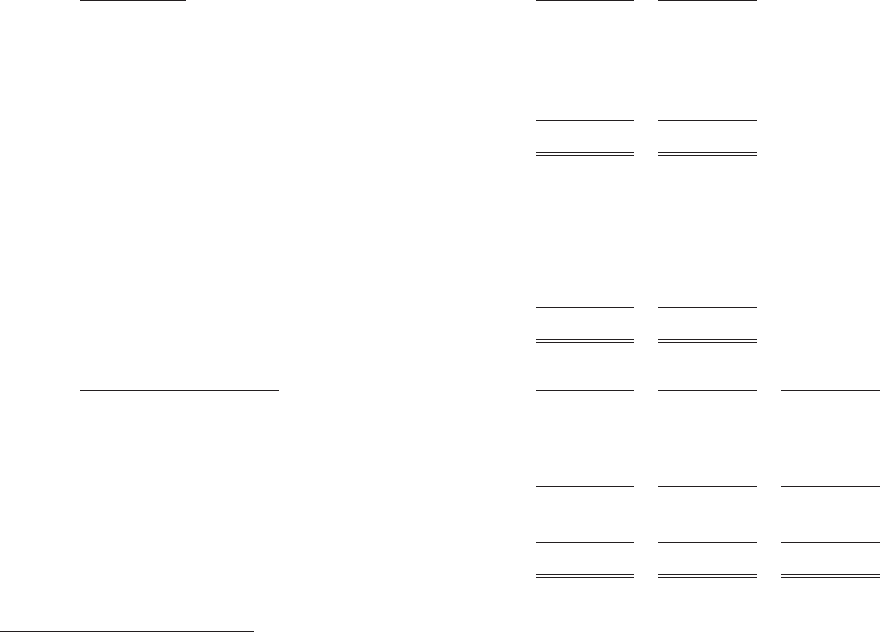

The following tables, which are based on information provided in part by third parties, summarize the

combined assets, liabilities and equity, and the combined results of operations of U.S. Cellular’s equity

method investments:

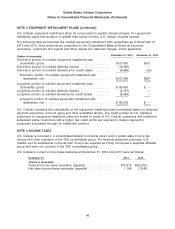

December 31, 2014 2013

(Dollars in thousands)

Assets

Current ........................... $ 691,519 $ 489,659

Due from affiliates .................... 303,322 408,735

Property and other ................... 2,295,936 2,026,104

$3,290,777 $2,924,498

Liabilities and Equity

Current liabilities ..................... $ 403,005 $ 351,624

Deferred credits ..................... 170,887 84,834

Long-term liabilities ................... 18,101 19,712

Long-term capital lease obligations ....... 1,722 707

Partners’ capital and shareholders’ equity . . . 2,697,062 2,467,621

$3,290,777 $2,924,498

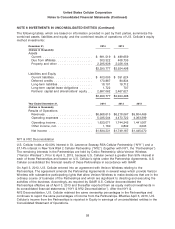

Year Ended December 31, 2014 2013 2012

(Dollars in thousands)

Results of Operations

Revenues .......................... $6,668,615 $6,218,067 $5,804,466

Operating expenses .................. 5,035,544 4,473,722 4,363,399

Operating income .................... 1,633,071 1,744,345 1,441,067

Other income, net .................... 1,160 4,842 4,003

Net income ........................ $1,634,231 $1,749,187 $1,445,070

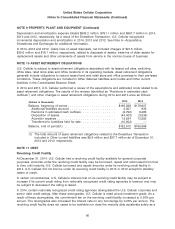

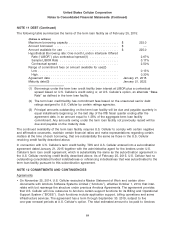

NY1 & NY2 Deconsolidation

U.S. Cellular holds a 60.00% interest in St. Lawrence Seaway RSA Cellular Partnership (‘‘NY1’’) and a

57.14% interest in New York RSA 2 Cellular Partnership (‘‘NY2’’) (together with NY1, the ‘‘Partnerships’’).

The remaining interests in the Partnerships are held by Cellco Partnership d/b/a Verizon Wireless

(‘‘Verizon Wireless’’). Prior to April 3, 2013, because U.S. Cellular owned a greater than 50% interest in

each of these Partnerships and based on U.S. Cellular’s rights under the Partnership Agreements, U.S.

Cellular consolidated the financial results of these Partnerships in accordance with GAAP.

On April 3, 2013, U.S. Cellular entered into an agreement with Verizon Wireless relating to the

Partnerships. The agreement amends the Partnership Agreements in several ways which provide Verizon

Wireless with substantive participating rights that allow Verizon Wireless to make decisions that are in the

ordinary course of business of the Partnerships and which are significant to directing and executing the

activities of the business. Accordingly, as required by GAAP, U.S. Cellular deconsolidated the

Partnerships effective as of April 3, 2013 and thereafter reported them as equity method investments in

its consolidated financial statements (‘‘NY1 & NY2 Deconsolidation’’). After the NY1 &

NY2 Deconsolidation, U.S. Cellular retained the same ownership percentages in the Partnerships and

continues to report the same percentages of income from the Partnerships. Effective April 3, 2013, U.S.

Cellular’s income from the Partnerships is reported in Equity in earnings of unconsolidated entities in the

Consolidated Statement of Operations.

58