US Cellular 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

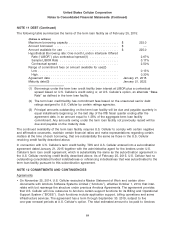

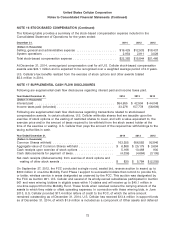

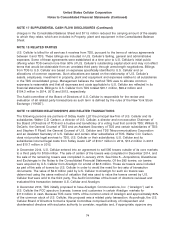

NOTE 15 COMMON SHAREHOLDERS’ EQUITY

Tax-Deferred Savings Plan

U.S. Cellular has reserved 67,215 Common Shares for issuance under the TDS Tax-Deferred Savings

Plan, a qualified profit-sharing plan pursuant to Sections 401(a) and 401(k) of the Internal Revenue Code.

Participating employees have the option of investing their contributions in a U.S. Cellular Common Share

fund, a TDS Common Share fund or certain unaffiliated funds.

Series A Common Shares

Series A Common Shares are convertible on a share-for-share basis into Common Shares. In matters

other than the election of directors, each Series A Common Share is entitled to ten votes per share,

compared to one vote for each Common Share. The Series A Common Shares are entitled to elect 75%

of the directors (rounded down), and the Common Shares elect 25% of the directors (rounded up). As of

December 31, 2014, a majority of U.S. Cellular’s outstanding Common Shares and all of U.S. Cellular’s

outstanding Series A Common Shares were held by TDS.

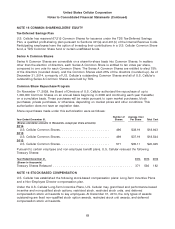

Common Share Repurchase Program

On November 17, 2009, the Board of Directors of U.S. Cellular authorized the repurchase of up to

1,300,000 Common Shares on an annual basis beginning in 2009 and continuing each year thereafter,

on a cumulative basis. These purchases will be made pursuant to open market purchases, block

purchases, private purchases, or otherwise, depending on market prices and other conditions. This

authorization does not have an expiration date.

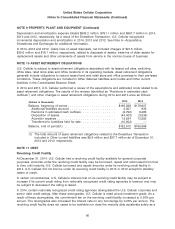

Share repurchases made under this authorization were as follows:

Number of Average Cost

Year Ended December 31, Shares Per Share Total Cost

(Shares and dollar amounts in thousands, except per share amounts)

2014

U.S. Cellular Common Shares ........................... 496 $38.19 $18,943

2013

U.S. Cellular Common Shares ........................... 499 $37.19 $18,544

2012

U.S. Cellular Common Shares ........................... 571 $35.11 $20,045

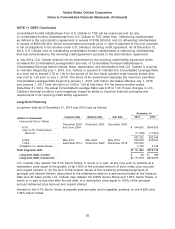

Pursuant to certain employee and non-employee benefit plans, U.S. Cellular reissued the following

Treasury Shares:

Year Ended December 31, 2014 2013 2012

(Shares in thousands)

Treasury Shares Reissued ........................................... 371 536 182

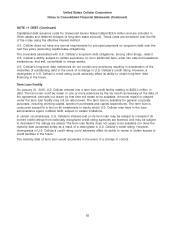

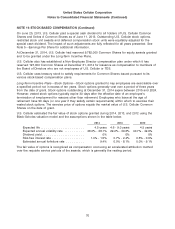

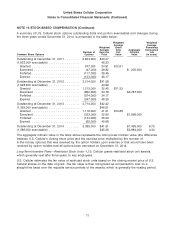

NOTE 16 STOCK-BASED COMPENSATION

U.S. Cellular has established the following stock-based compensation plans: Long-Term Incentive Plans

and a Non-Employee Director compensation plan.

Under the U.S. Cellular Long-Term Incentive Plans, U.S. Cellular may grant fixed and performance based

incentive and non-qualified stock options, restricted stock, restricted stock units, and deferred

compensation stock unit awards to key employees. At December 31, 2014, the only types of awards

outstanding are fixed non-qualified stock option awards, restricted stock unit awards, and deferred

compensation stock unit awards.

69