US Cellular 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

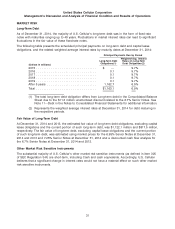

$11.3 million unamortized discount related to U.S. Cellular’s 6.7% Senior Notes. See Note 11—Debt

in the Notes to Consolidated Financial Statements for additional information

(2) Includes future lease costs related to office space, retail sites, cell sites and equipment. See

Note 12—Commitments and Contingencies in the Notes to Consolidated Financial Statements for

additional information.

(3) Includes obligations payable under non-cancellable contracts, commitments for network facilities and

transport services, agreements for software licensing, long-term marketing programs, and

agreements with Apple to purchase certain minimum quantities of Apple iPhone products and fund

marketing programs related to the Apple iPhone and iPad products. As described more fully in

Note 6—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial

Statements, U.S. Cellular expects to incur network-related exit costs in the Divestiture Markets as a

result of the transaction, including: (i) costs to decommission cell sites and mobile telephone

switching office (‘‘MTSO’’) sites, (ii) costs to terminate real property leases and (iii) costs to terminate

certain network access arrangements in the subject markets. The impacts of these exit activities on

U.S. Cellular’s purchase obligations are reflected in the table above only to the extent that

agreements were consummated at December 31, 2014.

The table above excludes liabilities related to ‘‘unrecognized tax benefits’’ as defined by GAAP because

U.S. Cellular is unable to predict the period of settlement of such liabilities. Such unrecognized tax

benefits were $36.1 million at December 31, 2014. See Note 4—Income Taxes in the Notes to

Consolidated Financial Statements for additional information on unrecognized tax benefits.

Agreements

• On November 25, 2014, U.S. Cellular executed a Master Statement of Work and certain other

documents with Amdocs Software Systems Limited (‘‘Amdocs’’), effective October 1, 2014, that inter-

relate with but rearrange the structure under previous Amdocs Agreements. The agreement provides

that U.S. Cellular will now outsource to Amdocs certain support functions for its Billing and Operational

Support System (‘‘B/OSS’’). Such functions include application support, billing operations and some

infrastructure services. The agreement has a term through September 30, 2019, subject to five

one-year renewal periods at U.S. Cellular’s option. The total estimated amount to be paid to Amdocs

with respect to the agreement during the initial five-year term is approximately $110 million (exclusive

of travel and expenses and subject to certain potential adjustments).

• During 2013, U.S. Cellular entered into agreements with Apple to purchase certain minimum quantities

of Apple iPhone products and fund marketing programs related to the Apple iPhone and iPad products

over a three-year period beginning in November 2013. Based on current forecasts, U.S. Cellular

estimates that the remaining contractual commitment as of December 31, 2014 under these

agreements is approximately $818 million. At this time, U.S. Cellular expects to meet its contractual

commitments with Apple.

Off-Balance Sheet Arrangements

U.S. Cellular had no transactions, agreements or other contractual arrangements with unconsolidated

entities involving ‘‘off-balance sheet arrangements,’’ as defined by SEC rules, that had or are reasonably

likely to have a material current or future effect on its financial condition, changes in financial condition,

revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

APPLICATION OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

U.S. Cellular prepares its consolidated financial statements in accordance with GAAP. U.S. Cellular’s

significant accounting policies are discussed in detail in Note 1—Summary of Significant Accounting

Policies and Recent Accounting Pronouncements in the Notes to Consolidated Financial Statements.

21