US Cellular 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

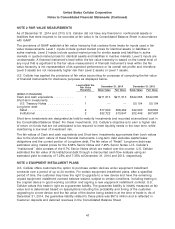

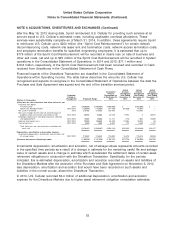

NOTE 3 EQUIPMENT INSTALLMENT PLANS (Continued)

U.S. Cellular equipment installment plans do not provide for explicit interest charges. For equipment

installment plans with duration of greater than twelve months, U.S. Cellular imputes interest.

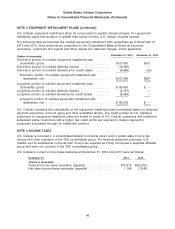

The following table summarizes the unbilled equipment installment plan receivables as of December 31,

2014 and 2013. Such amounts are presented on the Consolidated Balance Sheet as Accounts

receivable—customers and agents and Other assets and deferred charges, where applicable.

December 31, 2014 December 31, 2013

(Dollars in thousands)

Short-term portion of unbilled equipment installment plan

receivables, gross .................................. $127,400 $611

Short-term portion of unbilled deferred interest ............... (16,365) —

Short-term portion of unbilled allowance for credit losses ........ (3,686) (20)

Short-term portion of unbilled equipment installment plan

receivables, net ................................... $107,349 $591

Long-term portion of unbilled equipment installment plan

receivables, gross .................................. $ 89,435 $ —

Long-term portion of unbilled deferred interest ................ (2,791) —

Long-term portion of unbilled allowance for credit losses ........ (6,065) —

Long-term portion of unbilled equipment installment plan

receivables, net ................................... $ 80,579 $ —

U.S. Cellular considers the collectability of the equipment installment plan receivables based on historical

payment experience, account aging and other qualitative factors. The credit profiles of U.S. Cellular’s

customers on equipment installment plans are similar to those of U.S. Cellular customers with traditional

subsidized plans. Customers with a higher risk credit profile are required to make a deposit for

equipment purchased through an installment contract.

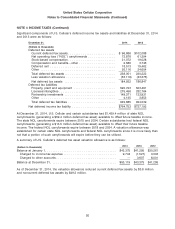

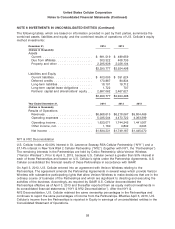

NOTE 4 INCOME TAXES

U.S. Cellular is included in a consolidated federal income tax return and in certain state income tax

returns with other members of the TDS consolidated group. For financial statement purposes, U.S.

Cellular and its subsidiaries compute their income tax expense as if they comprised a separate affiliated

group and were not included in the TDS consolidated group.

U.S. Cellular’s current income taxes balances at December 31, 2014 and 2013 were as follows:

December 31, 2014 2013

(Dollars in thousands)

Federal income taxes receivable (payable) ................. $73,510 $(32,351)

Net state income taxes receivable (payable) ................ 1,199 (1,545)

48