US Cellular 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

NOTE 6 ACQUISITIONS, DIVESTITURES AND EXCHANGES (Continued)

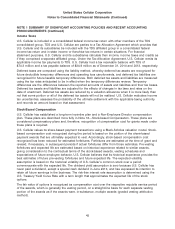

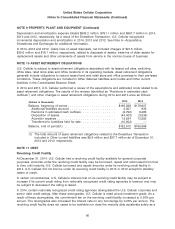

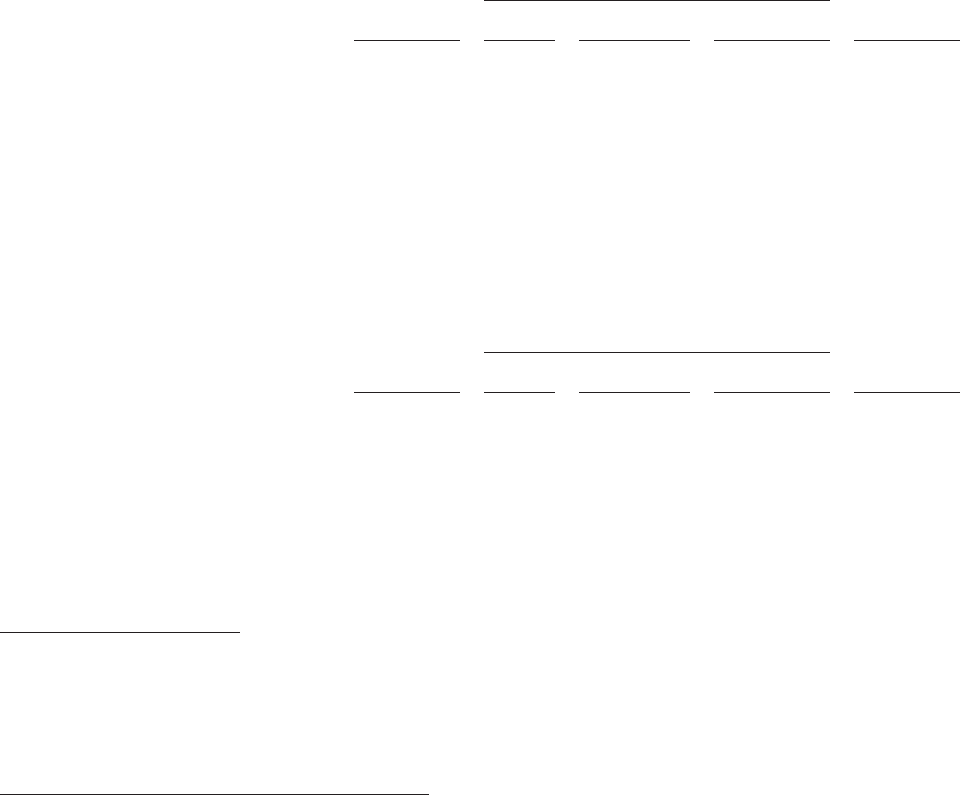

As a result of the transaction, U.S. Cellular recognized the following amounts in the Consolidated

Balance Sheet:

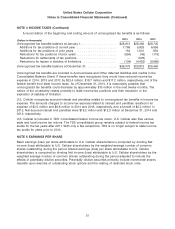

Year Ended December 31, 2014

Balance Balance

December 31, Costs Cash December 31,

2013 Incurred Settlements(1) Adjustments(2) 2014

(Dollars in thousands)

Accrued compensation

Employee related costs including

severance, retention,

outplacement ............. $ 2,053 $ 127 $ (1,223) $ (242) $ 715

Accounts payable—trade

Contract termination costs ...... $ — $ 4,018 $ — $ (1,190) $ 2,828

Other current liabilities

Contract termination costs ...... $13,992 $12,703 $(22,210) $ 3,747 $ 8,232

Other deferred liabilities and

credits

Contract termination costs ...... $30,849 $24,171 $ (3,569) $(30,411) $21,040

Year Ended December 31, 2013

Balance Balance

December 31, Costs Cash December 31,

2012 Incurred Settlements(1) Adjustments(2) 2013

(Dollars in thousands)

Accrued compensation

Employee related costs including

severance, retention,

outplacement ............. $12,305 $ 6,853 $(11,905) $(5,200) $ 2,053

Other current liabilities

Contract termination costs ...... $ 30 $22,675 $ (8,713) $ — $13,992

Other deferred liabilities and

credits

Contract termination costs ...... $ — $34,283 $ (3,434) $ — $30,849

(1) Cash settlement amounts are included in either the Net income or changes in Other assets and

liabilities line items as part of Cash flows from operating activities in the Consolidated Statement of

Cash Flows.

(2) Adjustment to liability represents changes to previously accrued amounts.

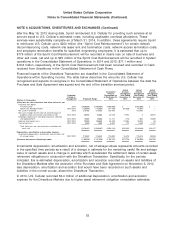

Other Acquisitions, Divestitures and Exchanges

• In December 2014, U.S. Cellular entered into an agreement with a third party to sell 595 towers and

certain related contracts, assets, and liabilities for approximately $159 million. This transaction was

accomplished in two closings. The first closing occurred in December 2014 and included the sale of

236 towers, without tenants, for $10.0 million. On this same date, U.S. Cellular received $7.5 million in

earnest money. At the time of the first closing, a $3.8 million gain was recorded in (Gain) loss on sale

of business and other exit costs, net. The second closing for the remaining 359 towers, primarily with

tenants, took place in January 2015, at which time U.S. Cellular received $141.5 million in additional

cash proceeds and recorded a gain of approximately $107 million. The assets and liabilities subject to

the second closing have been classified as ‘‘held for sale’’ in the Consolidated Balance Sheet as of

December 31, 2014.

54