US Cellular 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

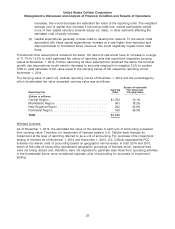

Management’s Discussion and Analysis of Financial Condition and Results of Operations

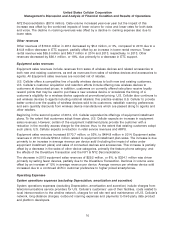

Income tax expense

The effective tax rates on Income before income taxes for 2014, 2013 and 2012 were 20.1%, 43.9% and

31.2%, respectively. The following significant discrete and other items impacted income tax expense for

these years:

2014—Includes tax expense of $6.4 million related to valuation allowance recorded against certain state

deferred tax assets. The effective tax rate in 2014 is lower due to the effect of this item combined with

the loss in 2014 in Income (loss) before income taxes.

2013—Includes tax expense of $20.4 million related to the NY1 & NY2 Deconsolidation and the

Divestiture Transaction, and a tax benefit of $5.4 million resulting from statute of limitation expirations.

2012—Includes tax benefits of $12.1 million resulting from statute of limitation expirations and

$5.3 million resulting from corrections relating to a prior period.

See Note 4—Income Taxes in the Notes to Consolidated Financial Statements for a discussion of income

tax expense and the overall effective tax rate on Income before income taxes.

Net income (loss) attributable to noncontrolling interests, net of tax

The decrease from 2013 to 2014 is due primarily to the elimination of the noncontrolling interest as a

result of the NY1 & NY2 Deconsolidation on April 3, 2013 and lower income from certain partnerships in

2014.

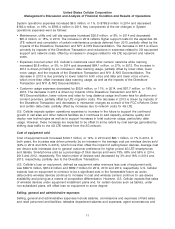

INFLATION

Management believes that inflation affects U.S. Cellular’s business to no greater or lesser extent than the

general economy.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

See Note 1—Summary of Significant Accounting Policies and Recent Accounting Pronouncements in the

Notes to Consolidated Financial Statements for information on recently issued accounting

pronouncements.

In general, recently issued accounting pronouncements did not have and are not expected to have a

significant effect on U.S. Cellular’s financial condition and results of operations, except for Accounting

Standards Update 2014-09, Revenue from Contracts with Customers. U.S. Cellular is evaluating the

effects of adoption of this standard on its financial condition and results of operations.

LIQUIDITY AND CAPITAL RESOURCES

CASH FLOWS

U.S. Cellular operates a capital-and marketing-intensive business. U.S. Cellular utilizes cash on hand,

cash from operating activities, cash proceeds from divestitures and disposition of investments, short-term

credit facilities and long-term debt financing to fund its acquisitions (including licenses), construction

costs, operating expenses and share repurchases. Cash flows may fluctuate from quarter to quarter and

year to year due to seasonality, the timing of acquisitions and divestitures, capital expenditures and other

14