US Cellular 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

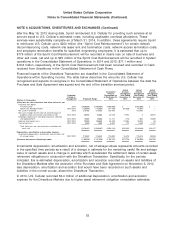

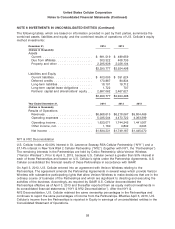

NOTE 9 PROPERTY, PLANT AND EQUIPMENT (Continued)

Depreciation and amortization expense totaled $593.2 million, $791.1 million and $597.7 million in 2014,

2013 and 2012, respectively. As a result of the Divestiture Transaction, U.S. Cellular recognized

incremental depreciation and amortization in 2014, 2013 and 2012. See Note 6—Acquisitions,

Divestitures and Exchanges for additional information.

In 2014, 2013 and 2012, (Gain) loss on asset disposals, net included charges of $21.5 million,

$30.6 million and $18.1 million, respectively, related to disposals of assets, trade-ins of older assets for

replacement assets and other retirements of assets from service in the normal course of business.

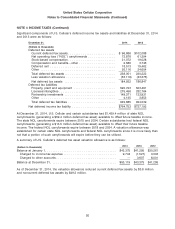

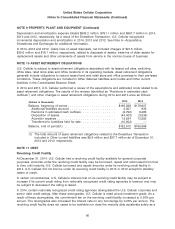

NOTE 10 ASSET RETIREMENT OBLIGATIONS

U.S. Cellular is subject to asset retirement obligations associated with its leased cell sites, switching

office sites, retail store sites and office locations in its operating markets. Asset retirement obligations

generally include obligations to restore leased land and retail store and office premises to their pre-lease

conditions. These obligations are included in Other deferred liabilities and credits and Other current

liabilities in the Consolidated Balance Sheet.

In 2014 and 2013, U.S. Cellular performed a review of the assumptions and estimated costs related to its

asset retirement obligations. The results of the reviews (identified as ‘‘Revisions in estimated cash

outflows’’) and other changes in asset retirement obligations during 2014 and 2013 were as follows:

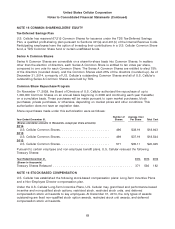

2014 2013

(Dollars in thousands)

Balance, beginning of period .......................... $195,568 $179,607

Additional liabilities accrued ......................... 2,507 635

Revisions in estimated cash outflows .................. (2,792) 6,268

Disposition of assets .............................. (44,403) (3,534)

Accretion expense ................................ 12,534 12,592

Transferred to Liabilities held for sale .................. (10,902) —

Balance, end of period(1) ............................ $152,512 $195,568

(1) The total amount of asset retirement obligations related to the Divestiture Transaction

included in Other current liabilities was $5.9 million and $37.7 million as of December 31,

2014 and 2013, respectively.

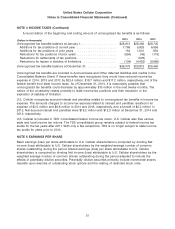

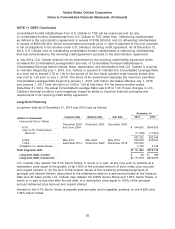

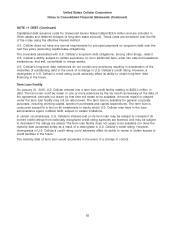

NOTE 11 DEBT

Revolving Credit Facility

At December 31, 2014, U.S. Cellular had a revolving credit facility available for general corporate

purposes. Amounts under the revolving credit facility may be borrowed, repaid and reborrowed from time

to time until maturity. U.S. Cellular borrowed and repaid amounts under its revolving credit facility in

2014. U.S. Cellular did not borrow under its revolving credit facility in 2013 or 2012 except for standby

letters of credit.

In certain circumstances, U.S. Cellular’s interest cost on its revolving credit facility may be subject to

increase if its current credit rating from nationally recognized credit rating agencies is lowered, and may

be subject to decrease if the rating is raised.

In 2014, certain nationally recognized credit rating agencies downgraded the U.S. Cellular corporate and

senior debt credit ratings. After these downgrades, U.S. Cellular is rated at sub-investment grade. As a

result of these downgrades, the commitment fee on the revolving credit facility increased to 0.30% per

annum. The downgrades also increased the interest rate on any borrowings by 0.25% per annum. The

revolving credit facility does not cease to be available nor does the maturity date accelerate solely as a

60