US Cellular 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

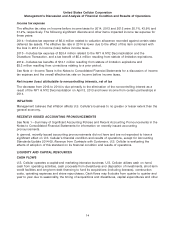

Management’s Discussion and Analysis of Financial Condition and Results of Operations

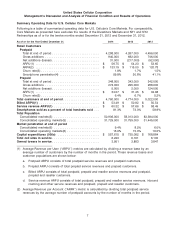

System operations expenses increased $6.5 million, or 1%, to $769.9 million in 2014 and decreased

$183.4 million, or 19%, to $763.4 million in 2013. Key components of the net changes in System

operations expenses were as follows:

• Maintenance, utility and cell site expenses increased $26.6 million, or 8%, in 2014 and decreased

$61.6 million, or 15%, in 2013. The increase in 2014 reflects higher support costs for the expanded 4G

LTE network and completion of certain maintenance projects deferred from 2013, partially offset by the

impacts of the Divestiture Transaction and NY1 & NY2 Deconsolidation. The decrease in 2013 is driven

primarily by impacts of the Divestiture Transaction and reductions in expenses related to 3G equipment

support and network costs, offset by increases in charges related to 4G LTE equipment and network

costs.

• Expenses incurred when U.S. Cellular’s customers used other carriers’ networks while roaming

increased $5.8 million, or 3%, in 2014 and decreased $64.1 million, or 27%, in 2013. The increase in

2014 is driven primarily by an increase in data roaming usage, partially offset by lower rates, lower

voice usage, and the impacts of the Divestiture Transaction and NY1 & NY2 Deconsolidation. The

decrease in 2013 is due primarily to lower rates for both voice and data and lower voice volume,

which more than offset increased data roaming usage, as well as the impacts of the Divestiture

Transaction and NY1 & NY2 Deconsolidation.

• Customer usage expenses decreased by $25.9 million, or 11%, in 2014, and $57.7 million, or 19%, in

2013. The decrease in 2014 is driven by impacts of the Divestiture Transaction and NY1 &

NY2 Deconsolidation, lower volume and rates for long distance usage and lower fees for platform and

content providers, partially offset by LTE migration costs. The decrease in 2013 is driven by impacts of

the Divestiture Transaction and decreases in intercarrier charges as a result of the FCC’s Reform Order

and certain data costs, partially offset by increases due to network costs for 4G LTE.

U.S. Cellular expects system operations expenses to increase in the future to support the continued

growth in cell sites and other network facilities as it continues to add capacity, enhance quality and

deploy new technologies as well as to support increases in total customer usage, particularly data

usage. However, these increases are expected to be offset to some extent by cost savings generated by

shifting data traffic to the 4G LTE network from the 3G network.

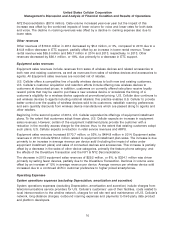

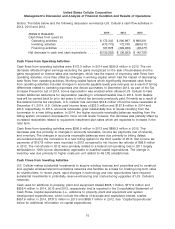

Cost of equipment sold

Cost of equipment sold increased $193.7 million, or 19%, in 2014 and $63.1 million, or 7% in 2013. In

both years, the increase was driven primarily by an increase in the average cost per wireless device sold

(22% in 2014 and 33% in 2013), which more than offset the impact of selling fewer devices. Average cost

per device sold increased due to general customer preference for higher priced 4G LTE smartphones

and tablets. Smartphones sold as a percentage of total devices sold were 73%, 68% and 56% in 2014,

2013 and 2012, respectively. The total number of devices sold decreased by 3% and 18% in 2014 and

2013, respectively, partially due to the Divestiture Transaction.

U.S. Cellular’s loss on equipment, defined as equipment sales revenues less cost of equipment sold,

was $697.9 million, $674.9 million and $582.7 million for 2014, 2013 and 2012, respectively. U.S. Cellular

expects loss on equipment to continue to be a significant cost in the foreseeable future as iconic

data-centric wireless devices continue to increase in cost and wireless carriers continue to use device

availability and pricing as a means of competitive differentiation. However, U.S. Cellular expects that sales

of wireless devices under equipment installment plans and, for certain devices such as tablets, under

non-subsidized plans, will offset loss on equipment to some degree.

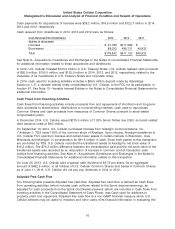

Selling, general and administrative expenses

Selling, general and administrative expenses include salaries, commissions and expenses of field sales

and retail personnel and facilities; telesales department salaries and expenses; agent commissions and

11