US Cellular 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

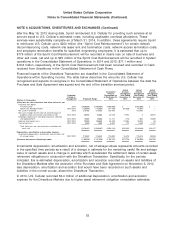

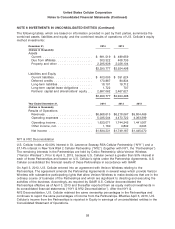

NOTE 8 INVESTMENTS IN UNCONSOLIDATED ENTITIES (Continued)

In accordance with GAAP, as a result of the NY1 & NY2 Deconsolidation, U.S. Cellular’s interest in the

Partnerships was reflected in Investments in unconsolidated entities at a fair value of $114.8 million as of

April 3, 2013. Recording U.S. Cellular’s interest in the Partnerships required allocation of the excess of

fair value over book value to customer lists, licenses, a favorable contract and goodwill of the

Partnerships. Amortization expense related to customer lists and the favorable contract will be recognized

over their respective useful lives and is included in Equity in earnings of unconsolidated entities in the

Consolidated Statement of Operations. In addition, U.S. Cellular recognized a non-cash pre-tax gain of

$18.5 million in the second quarter of 2013. The gain was recorded in Gain (loss) on investments in the

Consolidated Statement of Operations.

The Partnerships were valued using a discounted cash flow approach and a guideline public company

method. The discounted cash flow approach uses value drivers and risks specific to the industry and

current economic factors and incorporates assumptions that market participants would use in their

estimates of fair value and may not be indicative of U.S. Cellular specific assumptions. The most

significant assumptions made in this process were the revenue growth rate (shown as a simple average

in the table below), the terminal revenue growth rate, discount rate and capital expenditures. The

assumptions were as follows:

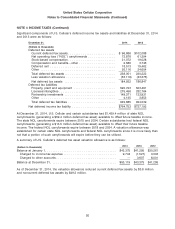

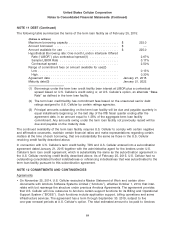

Key assumptions

Average expected revenue growth rate (next ten years) .............. 2.0%

Terminal revenue growth rate (after year ten) ...................... 2.0%

Discount rate ............................................. 10.5%

Capital expenditures as a percentage of revenue ................... 14.9 - 18.8%

The guideline public company method develops an indication of fair value by calculating average market

pricing multiples for selected publicly-traded companies. The developed multiples were applied to

applicable financial measures of the Partnerships to determine fair value. The discounted cash flow

approach and guideline public company method were weighted to arrive at the total fair value of the

Partnerships.

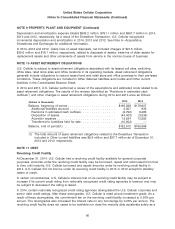

NOTE 9 PROPERTY, PLANT AND EQUIPMENT

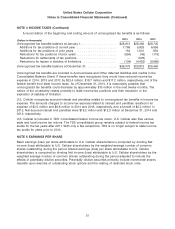

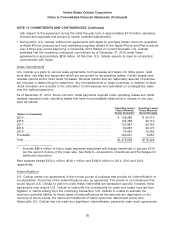

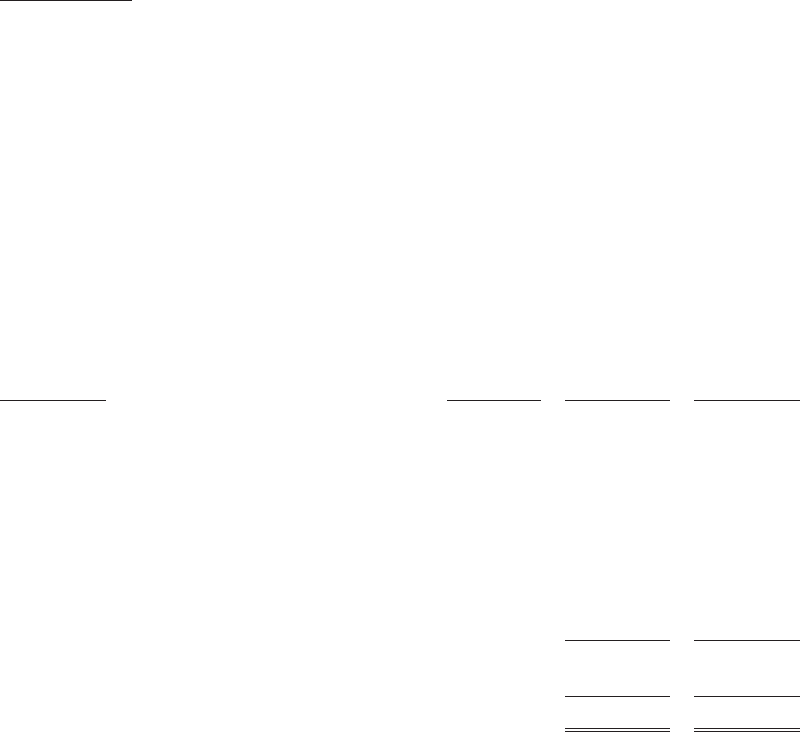

Property, plant and equipment in service and under construction, and related accumulated depreciation

and amortization, as of December 31, 2014 and 2013 were as follows:

Useful Lives

December 31, (Years) 2014 2013

(Dollars in thousands)

Land .............................. N/A $ 35,031 $ 36,266

Buildings ........................... 20 296,502 304,272

Leasehold and land improvements ......... 1-30 1,086,718 1,197,520

Cell site equipment .................... 7-25 3,269,609 3,306,575

Switching equipment .................. 5-8 960,377 1,161,976

Office furniture and equipment ............ 3-5 553,630 539,248

Other operating assets and equipment ...... 3-5 89,663 92,456

System development .................. 1-7 1,042,195 962,698

Work in process ...................... N/A 125,015 116,501

7,458,740 7,717,512

Accumulated depreciation and amortization . . (4,730,523) (4,860,992)

$ 2,728,217 $ 2,856,520

59