US Cellular 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

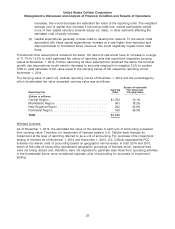

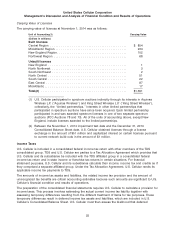

Developed operating market licenses (‘‘built licenses’’)

U.S. Cellular applies the build-out method to estimate the fair values of built licenses. The most

significant assumptions applied for purposes of the licenses impairment assessment were as follows:

November 1,

Key Assumptions 2014

Build-out period(1) ......................................... 5 years

Discount rate(2) ........................................... 8.75%

Terminal revenue growth rate ................................. 2.0%

Terminal capital expenditures as a percentage of revenue ............ 14.5%

Customer penetration rates .................................. 12.0-16.3%

(1) The build-out period represents the estimated time to perform a hypothetical build of the

network. Changes in the estimated build-out period can occur as a result of changes in

resources and technology. Such changes could negatively or positively impact the results.

(2) The discount rate used in the valuation of licenses is less than the discount rate used in the

valuation of reporting units for purposes of goodwill impairment testing. The discount rate

used for licenses includes a reduced company-specific risk premium as it is assumed a

market participant starting a greenfield build would construct and operate its network in an

optimal manner and would not be constrained by the current network and operations

associated with a mature wireless company. The discount rate is estimated based on the

overall risk-free interest rate adjusted for industry participant information, such as a typical

capital structure (i.e., debt-equity ratio), the after-tax cost of debt and the cost of equity. The

cost of equity takes into consideration the average risk specific to individual market

participants. The weighted average cost of capital may increase if borrowing costs rise,

market participants weight more of their capital structure towards equity (vs. debt), or other

elements affecting the estimated cost of equity increase.

As of November 1, 2014, the fair values of the built licenses units of accounting exceeded their

respective carrying values by amounts ranging from 12.8% to 42.9%. The discount rate would have to

increase to a range of 9.0% to 9.3% to yield estimated fair values of licenses in the respective units of

accounting that equal their respective carrying values at November 1, 2014.

Non-operating market licenses (‘‘unbuilt licenses’’)

For purposes of performing impairment testing of unbuilt licenses, the fair value of the unbuilt licenses is

assumed to have changed by the same percentage, and in the same direction, that the fair value of built

licenses measured using the build-out method changed during the period. There was no impairment loss

recognized related to unbuilt licenses as a result of the November 1, 2014 licenses impairment test.

24