Starwood 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

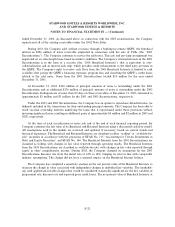

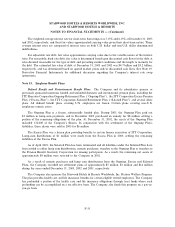

of LIBOR ° 1.625%. The proceeds of the new Senior Credit Facility were used to pay oÅ all amounts owed

under the Company's previous senior credit facility, which was due to mature in February 2003. The Company

incurred a charge of approximately $1 million in connection with this early extinguishment of debt.

In April 2002, the Company sold $1.5 billion of senior notes in two tranches Ì $700 million principal

amount of 7

3

/

8

% senior notes due 2007 and $800 million principal amount of 7

7

/

8

% senior notes due 2012. The

Company used the proceeds to repay all of its senior secured notes facility and a portion of its previous senior

credit facility. In connection with the repayment of debt, the Company incurred charges of approximately

$29 million including approximately $23 million for the early termination of interest rate swap agreements

associated with the repaid debt, and $6 million for the write-oÅ of deferred Ñnancing costs and termination

fees for the early extinguishment of debt.

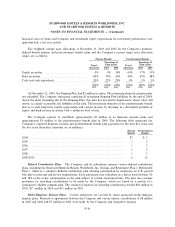

In December 2001, the Company entered into an 18-month 450 million Euro loan that automatically

extended for six additional months until December 2003. The loan had an interest rate of Euribor plus 195

basis points. In connection with the sale of the Sardinia Assets and the Principe, the Euro loan was paid in full

during 2003.

In May 2001, the Company sold an aggregate face amount of $816 million zero coupon Convertible

Senior Notes due 2021. The two series of notes had an initial blended yield to maturity of 2.35%. The notes are

convertible, subject to certain conditions, into an aggregate 9,657,000 Shares. The Company received gross

proceeds from these sales of approximately $500 million, which were used to repay a portion of its senior

secured notes facility that bore interest at LIBOR plus 275 basis points. The Company incurred approximately

$9 million of charges in connection with this early debt extinguishment. In May 2002, the Company

repurchased all of the outstanding Series A Convertible Senior Notes for $202 million in cash. Holders of

Series B Convertible Senior Notes may Ñrst put these notes to the Company in May 2004 for a purchase price

of approximately $330 million. The Company has classiÑed this debt maturity as long-term as it has the intent

and ability to draw on its Revolving Credit Facility for such funding, if required.

The Company has the ability to draw down on its Revolving Credit Facility in various currencies.

Drawdowns in currencies other than the U.S. dollar represent a natural hedge of the Company's foreign

denominated net assets and operations. At December 31, 2003, the Company had $15 million drawn in

Canadian dollars.

The Senior Credit Facility, Senior Notes, Convertible Senior Notes and the Convertible Debt are

guaranteed by the Sheraton Holding Corporation, a wholly owned subsidiary of the Corporation. The Sheraton

Holding public debt is guaranteed by the Corporation. See Note 23. Guarantor Subsidiary for consolidating

Ñnancial information for Starwood Hotels & Resorts Worldwide, Inc. (the ""Parent''), Sheraton Holding

Corporation (the ""Guarantor Subsidiary'') and all other legal entities that are consolidated into the

Company's results including the Trust, but which are not the Guarantor Subsidiary (the ""Non-Guarantor

Subsidiaries'').

The Company maintains lines of credit under which bank loans and other short-term debt are drawn. In

addition, smaller credit lines are maintained by the Company's foreign subsidiaries. The Company had

approximately $900 million of available borrowing capacity under its domestic and foreign lines of credit as of

December 31, 2003.

The Company is subject to certain restrictive debt covenants under its short-term borrowing and long-

term debt obligations including deÑned Ñnancial covenants, limitations on incurring additional debt, escrow

account funding requirements for debt service, capital expenditures, tax payments and insurance premiums,

among other restrictions. The Company was in compliance with all of the short-term and long-term debt

covenants at December 31, 2003.

F-32