Starwood 2003 Annual Report Download - page 84

Download and view the complete annual report

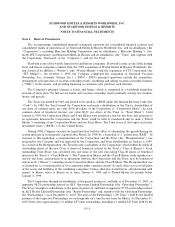

Please find page 84 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

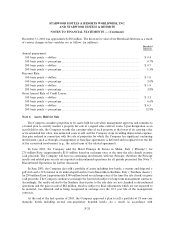

for available-for-sale securities. The Company had BeneÑcial and Retained Interests of $50 million and

$47 million at December 31, 2003 and 2002, respectively.

Use of Estimates. The preparation of Ñnancial statements in conformity with accounting principles

generally accepted in the United States requires management to make estimates and assumptions that aÅect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of

the Ñnancial statements and the reported amounts of revenues and expenses during the reporting period.

Actual results could diÅer from those estimates.

ReclassiÑcations. Certain reclassiÑcations have been made to the prior years' Ñnancial statements to

conform to the current year presentation.

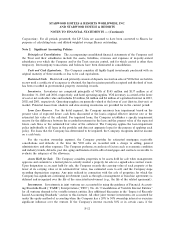

Impact of Recently Issued Accounting Standards. In December 2003, FASB issued SFAS No. 132

(revised 2003), ""Employers' Disclosures about Pensions and Other Postretirement BeneÑts'' (SFAS

No. 132-(R)). SFAS No. 132-(R) retains the disclosure requirements in the original SFAS No. 132, but

requires additional disclosures related to plan assets, plan obligations, cash Öows and net periodic beneÑt cost

of deÑned beneÑt pension and other postretirement plans. In addition, this statement requires interim period

disclosure of the components of net periodic beneÑt costs and contributions if signiÑcantly diÅerent from

previously reported amounts. The Company adopted SFAS No. 132-(R) eÅective December 31, 2003 for its

domestic pension and postretirement plans, and incorporated the new disclosure requirements into Note 15.

Employee BeneÑt Plans. SFAS No. 132-(R) is eÅective December 31, 2004 for the Company's foreign

pension plans.

In May 2003, FASB issued SFAS No. 150 ""Accounting for Certain Financial Instruments with

Characteristics of both Liabilities and Equity.'' This statement establishes standards for how an issuer

classiÑes and measures certain Ñnancial instruments with characteristics of both liabilities and equity, and is

eÅective for Ñnancial instruments entered into or modiÑed after May 31, 2003, and otherwise is eÅective at the

beginning of the Ñrst interim period beginning after June 15, 2003. As a result of further discussion by the

FASB on October 8, 2003, the FASB announced that minority interests in consolidated partnerships with

speciÑed Ñnite lives should be reclassiÑed as liabilities and presented at fair market value unless the interests

are convertible into the equity of the parent. Fair market value adjustments occurring subsequent to July 1,

2003 should be recorded as a component of interest expense. At their October 29, 2003 meeting, the FASB

agreed to indeÑnitely defer the implementation of their announcement at the October 8, 2003 meeting

regarding the accounting treatment for minority interests in Ñnite life partnerships. Therefore, until a Ñnal

resolution is reached, the Company will not implement this aspect of the standard. If the Company were to

adopt this aspect of the standard under its current provisions, it is not expected to have a material impact on

the Company's Ñnancial statements.

In April 2003, the FASB issued SFAS No. 149, ""Amendment of Statement 133 on Derivative

Instruments and Hedging Activities'' which amends and clariÑes Ñnancial accounting and reporting for

derivative instruments and hedging activities, including the qualiÑcations for the normal purchases and normal

sales exception, under SFAS No. 133, ""Accounting for Derivative Instruments and Hedging Activities.'' The

amendment reÖects decisions made by the FASB in connection with issues raised about the application of

SFAS No. 133. Generally, the provisions of SFAS No. 149 will be applied prospectively for contracts entered

into or modiÑed after June 30, 2003, and for hedging relationships designated after June 30, 2003. Adoption of

SFAS No. 149 did not have a material eÅect on the Company's Ñnancial statements.

In January 2003, the FASB issued FIN 46 which requires a variable interest entity (""VIE'') to be

consolidated by its primary beneÑciary (""PB''). The PB is the party that absorbs a majority of the VIE's

expected losses and/or receives a majority of the expected residual returns.

F-18