Starwood 2003 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

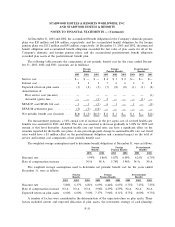

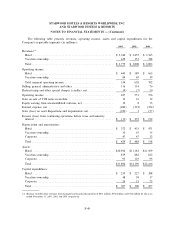

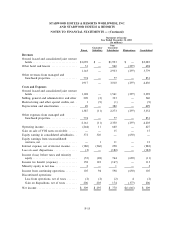

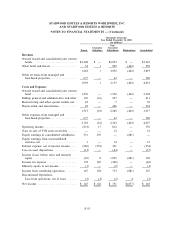

The Company had the following commercial commitments outstanding as of December 31, 2003 (in

millions):

Amount of Commitment Expiration Per Period

Less Than After

Total 1 Year 1-3 Years 4-5 Years 5 Years

Standby letters of creditÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $129 $129 $Ì $Ì $Ì

Hotel loan guarantees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 144 39 75 Ì 30

Other commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì Ì

Total commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $273 $168 $75 $Ì $30

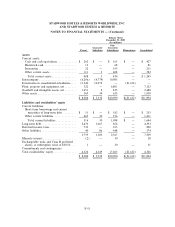

Guaranteed Loans and Commitments. In limited cases, the Company has made loans to owners of or

partners in hotel or resort ventures for which the Company has a management or franchise agreement. Loans

outstanding under this program totaled $163 million at December 31, 2003. The Company evaluates these

loans for impairment, and at December 31, 2003, believes these loans are collectible. Unfunded loan

commitments aggregating $70 million were outstanding at December 31, 2003, of which $42 million are

expected to be funded in 2004 and $52 million are expected to be funded in total. These loans typically are

secured by pledges of project ownership interests and/or mortgages on the projects. The Company also has

$75 million of equity and other potential contributions associated with managed or joint venture properties,

$24 million of which is expected to be funded in 2004.

The Company participates in programs with unaÇliated lenders in which the Company may partially

guarantee loans made to facilitate third-party ownership of hotels that the Company manages or franchises. As

of December 31, 2003, the Company was a guarantor for loans which could reach a maximum of $144 million

relating to three projects: the St. Regis in Monarch Beach, California, which opened in mid-2001; the Westin

Kierland Resort and Spa in Scottsdale, Arizona, which opened in November 2002; and the Westin in

Charlotte, North Carolina, which opened in April 2003. In connection with the loan guarantee for the Westin

Charlotte, the Company also entered into a guarantee to fund working capital shortfalls for this resort through

2005. No signiÑcant fundings are anticipated under this working capital guarantee. The Company does not

anticipate any funding under the remaining loan guarantees in 2004, as all projects are well capitalized.

Furthermore, since each of these properties was funded with signiÑcant equity and subordinated debt

Ñnancing, if the Company's loan guarantees were to be called, the Company could take an equity position in

these properties at values signiÑcantly below construction costs.

Surety bonds issued on behalf of the Company as of December 31, 2003 totaled $46 million, the majority

of which were required by state or local governments relating to our vacation ownership operations and by our

insurers to secure large deductible insurance programs.

In order to secure management contracts, the Company may provide performance guarantees to third-

party owners. Most of these performance guarantees allow the Company to terminate the contract rather than

fund shortfalls if certain performance levels are not met. In limited cases, the Company is obliged to fund

shortfalls in performance levels. As of December 31, 2003, the Company had seven management contracts

with performance guarantees with possible cash outlays of up to $74 million, $50 million of which, if required,

would be funded over a period of 25 years and would be largely oÅset by management fees received under

these contracts. Many of the performance tests are multi-year tests, are tied to the results of a competitive set

of hotels, and have exclusions for force majeure and acts of war and terrorism. The Company does not

anticipate any signiÑcant funding under the performance guarantees in 2004. In addition, the Company has

agreed to guarantee certain performance levels at a managed property that has authorized VOI sales and

marketing. The exact amount and nature of the guaranty is currently under dispute. However, the Company

F-45