Starwood 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Surety bonds issued on behalf of the Company as of December 31, 2003 totaled $46 million, the majority

of which were required by state or local governments relating to our vacation ownership operations and by our

insurers to secure large deductible insurance programs.

To secure management contracts, the Company may provide performance guarantees to third-party

owners. Most of these performance guarantees allow the owner to terminate the contract if the Company

elects not to fund shortfalls if certain performance levels are not met. In limited cases, the Company is obliged

to fund shortfalls in performance levels. As of December 31, 2003, the Company had seven management

contracts with performance guarantees with possible cash outlays of up to $74 million, $50 million of which, if

required, would be funded over a period of 25 years and would be largely oÅset by management fees received

under these contracts. Many of the performance tests are multi-year tests, are tied to the results of a

competitive set of hotels, and have exclusions for force majeure and acts of war and terrorism. The Company

does not anticipate any signiÑcant funding under the performance guarantees in 2004. In addition, the

Company has agreed to guarantee certain performance levels at a managed property that has authorized VOI

sales and marketing. The exact amount and nature of the guaranty is currently under dispute. However, the

Company does not believe that any payments under this guaranty will be signiÑcant. Lastly, the Company

does not anticipate losing a signiÑcant number of management or franchise contracts in 2004.

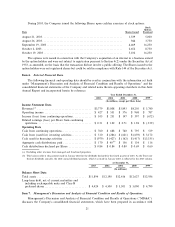

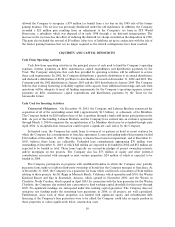

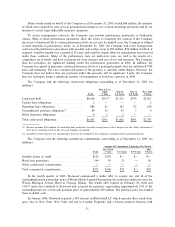

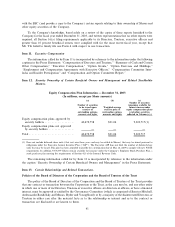

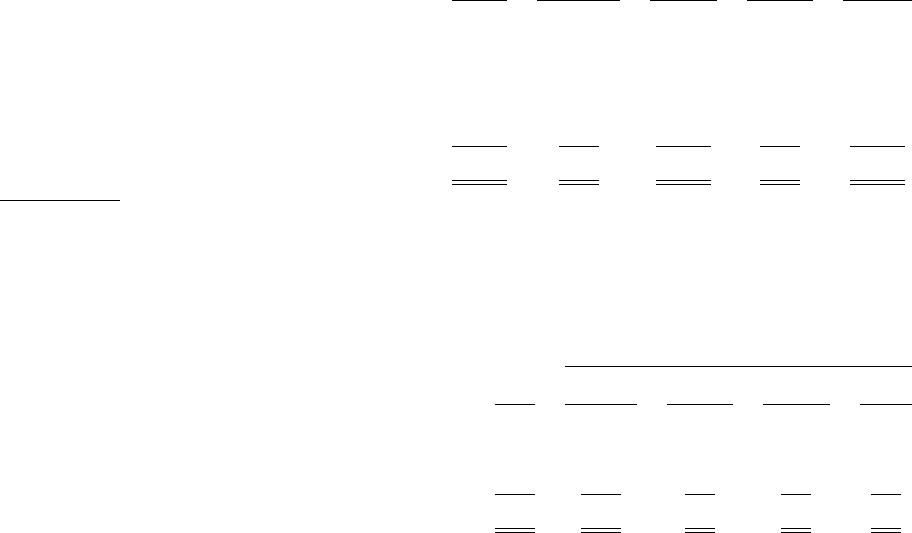

The Company had the following contractual obligations outstanding as of December 31, 2003 (in

millions):

Due in Less

Than Due in Due in Due After

Total 1 Year 1-3 Years 4-5 Years 5 Years

Long-term debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $4,624 $233(1) $1,532 $792 $2,067

Capital lease obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2 Ì Ì Ì 2

Operating lease obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 888 61 105 92 630

Unconditional purchase obligations(2) ÏÏÏÏÏÏÏÏÏÏÏ 89 35 43 7 4

Other long-term obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4 2 2 Ì Ì

Total contractual obligationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $5,607 $331 $1,682 $891 $2,703

(1) Balance excludes $326 million of convertible debt maturities classiÑed as long-term as the Company has the ability and intent to

draw on its revolving credit facility for such fundings, if required.

(2) Included in these balances are commitments that may be satisÑed by the Company's managed and franchised properties.

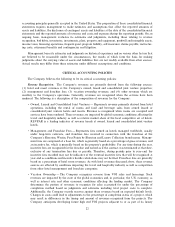

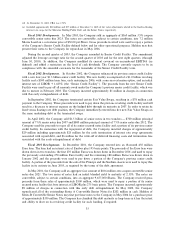

The Company had the following commercial commitments outstanding as of December 31, 2003 (in

millions):

Amount of Commitment Expiration Per Period

Less Than After

Total 1 Year 1-3 Years 4-5 Years 5 Years

Standby letters of creditÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $129 $129 $Ì $Ì $Ì

Hotel loan guarantees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 144 39 75 Ì 30

Other commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì Ì

Total commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $273 $168 $75 $Ì $30

In the fourth quarter of 2003, Starwood commenced a tender oÅer to acquire any and all of the

outstanding limited partnership units of Westin Hotels Limited Partnership, the entity that indirectly owns the

Westin Michigan Avenue Hotel in Chicago, Illinois. The tender oÅer expired on February 20, 2004 and

33,873 units were tendered to Starwood and accepted for payment, representing approximately 25% of the

outstanding units for a total cash purchase price of approximately $25 million. The purchase price was funded

from available cash.

In January 2004, Starwood acquired a 95% interest in Blissworld LLC which operates three stand alone

spas (two in New York, New York and one in London, England) and a beauty products business with

31