Starwood 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

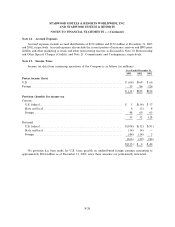

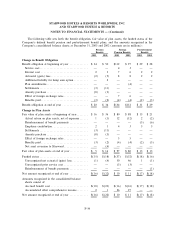

At December 31, 2003 and 2002, the accumulated beneÑt obligation for the Company's domestic pension

plans was $20 million and $34 million, respectively, and the accumulated beneÑt obligation for the foreign

pension plans was $112 million and $95 million, respectively. At December 31, 2003 and 2002, the projected

beneÑt obligation and accumulated beneÑt obligation exceeded the fair value of plan assets for all of the

Company's domestic and foreign pension plans, and the accumulated postretirement beneÑt obligation

exceeded plan assets of the postretirement beneÑt plan.

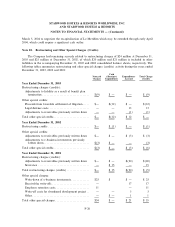

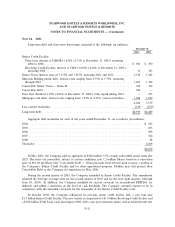

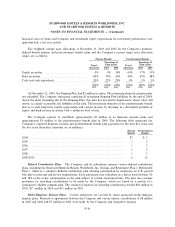

The following table presents the components of net periodic beneÑt cost for the years ended Decem-

ber 31, 2003, 2002 and 2001 (amounts are in millions):

Pension Foreign Postretirement

BeneÑts Pension BeneÑts BeneÑts

2003 2002 2001 2003 2002 2001 2003 2002 2001

Service cost ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $ Ì $ Ì $ 4 $ 3 $ 2 $Ì $Ì $Ì

Interest cost ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2 3 3 766222

Expected return on plan assets ÏÏÏÏÏÏÏÏ (1) (2) (3) (7) (8) (8) (1) (1) (2)

Amortization of:

Prior service cost (income) ÏÏÏÏÏÏÏÏÏ Ì Ì Ì ÌÌÌÌÌ(1)

Actuarial (gain) lossÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì (1) 2ÌÌÌ(1)Ì

SFAS 87 cost/SFAS 106 costÏÏÏÏÏÏÏÏÏ 1 1 (1) 6 1 Ì 1 Ì (1)

SFAS 88 settlement gain ÏÏÏÏÏÏÏÏÏÏÏÏÏ (5) (3) (14) ÌÌÌÌÌÌ

Net periodic beneÑt cost (income)ÏÏÏÏÏ $(4) $ (2) $(15) $ 6 $ 1 $Ì $ 1 $Ì $(1)

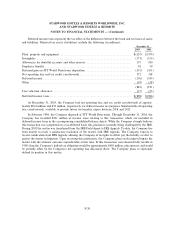

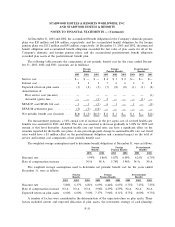

For measurement purposes, a 10% annual rate of increase in the per capita cost of covered health care

beneÑts was assumed for 2003 and 2004. The rate was assumed to decrease gradually to 5.00% for 2009 and

remain at that level thereafter. Assumed health care cost trend rates can have a signiÑcant eÅect on the

amounts reported for the health care plans. A one-percentage-point change in assumed health care cost trend

rates would have a $1 million eÅect on the postretirement obligation and a nominal impact on the total of

service and interest cost components of net periodic beneÑt cost.

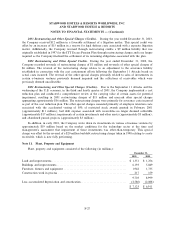

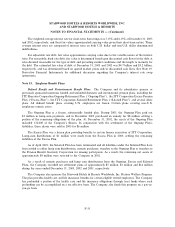

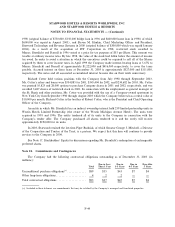

The weighted average assumptions used to determine beneÑt obligations at December 31, were as follows:

Pension Foreign Postretirement

BeneÑts Pension BeneÑts BeneÑts

2003 2002 2003 2002 2003 2002

Discount rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.99% 5.86% 5.87% 6.09% 6.25% 6.75%

Rate of compensation increaseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ N/A N/A 3.74% 3.96% N/A N/A

The weighted average assumptions used to determine net periodic beneÑt cost for the years ended

December 31, were as follows:

Pension Foreign Postretirement

BeneÑts Pension BeneÑts BeneÑts

2003 2002 2001 2003 2002 2001 2003 2002 2001

Discount rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.86% 6.37% 6.81% 6.09% 6.44% 6.63% 6.75% 7.25% 7.25%

Rate of compensation increase N/A N/A N/A 3.96% 4.29% 4.59% N/A N/A N/A

Expected return on plan assets 6.00% 6.00% 7.00% 7.37% 7.94% 8.11% 8.75% 8.00% 9.75%

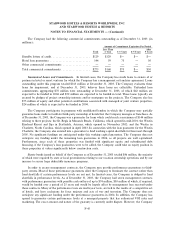

A number of factors were considered in the determination of the expected return on plan assets. These

factors included current and expected allocation of plan assets, the investment strategy of cash planning,

F-35