Starwood 2003 Annual Report Download - page 77

Download and view the complete annual report

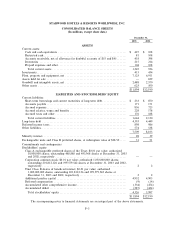

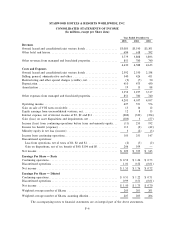

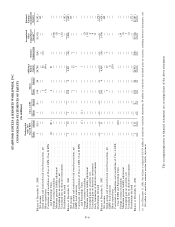

Please find page 77 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS

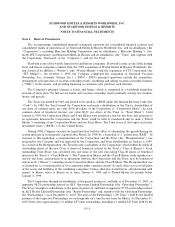

Note 1. Basis of Presentation

The accompanying consolidated Ñnancial statements represent the consolidated Ñnancial position and

consolidated results of operations of (i) Starwood Hotels & Resorts Worldwide, Inc. and its subsidiaries (the

""Corporation''), including Sheraton Holding Corporation and its subsidiaries (""Sheraton Holding'') (for-

merly ITT Corporation) and Starwood Hotels & Resorts and its subsidiaries (the ""Trust'' and, together with

the Corporation, ""Starwood'' or the ""Company''), and (ii) the Trust.

Starwood is one of the world's largest hotel and leisure companies. Starwood's status as one of the leading

hotel and leisure companies resulted from the 1998 acquisition of Westin Hotels & Resorts Worldwide, Inc.

and certain of its aÇliates (""Westin'') (the ""Westin Merger'') and the acquisition of ITT Corporation (the

""ITT Merger''). On October 1, 1999, the Company completed the acquisition of Starwood Vacation

Ownership, Inc. (formerly Vistana, Inc.) (""SVO''). SVO's principal operations include the acquisition,

development and operation of vacation ownership resorts; marketing and selling vacation ownership interests

(""VOIs'') in the resorts; and providing Ñnancing to customers who purchase such interests.

The Company's principal business is hotels and leisure, which is comprised of a worldwide hospitality

network of more than 750 full-service hotels and vacation ownership resorts primarily serving two markets:

luxury and upscale.

The Trust was formed in 1969 and elected to be taxed as a REIT under the Internal Revenue Code (the

""Code''). In 1980, the Trust formed the Corporation and made a distribution to the Trust's shareholders of

one share of common stock, par value $0.01 per share, of the Corporation (a ""Corporation Share'') for each

common share of beneÑcial interest, par value $0.01 per share, of the Trust (a ""Trust Share''). Until

January 6, 1999, the Corporation Shares and Trust Shares were paired on a one-for-one basis and, pursuant to

an agreement between the Corporation and the Trust, could be held or transferred only in units (""Paired

Shares'') consisting of one Corporation Share and one Trust Share. The Trust is one of the largest real estate

investment trusts (""REITs'') in the United States.

During 1998, Congress enacted tax legislation that had the eÅect of eliminating the grandfathering for

certain interests in real property acquired after March 26, 1998 by a formation of a ""paired share REIT.'' In

response to this legislation, a reorganization of the Corporation and the Trust (the ""Reorganization'') was

proposed by the Company and was approved by the Corporation and Trust shareholders on January 6, 1999.

As a result of the Reorganization, the Trust became a subsidiary of the Corporation, which indirectly holds all

outstanding shares of the new Class A shares of beneÑcial interest in the Trust (""Class A Shares''). Each

outstanding Trust Share was converted into one share of the new non-voting Class B shares of beneÑcial

interest in the Trust (a ""Class B Share''). The Corporation Shares and the Class B Shares trade together on a

one-for-one basis, and pursuant to an agreement between the Corporation and the Trust, may be transferred

only in units (""Shares'') consisting of one Corporation Share and one Class B Share. The Reorganization was

accounted for as a reorganization of two companies under common control. As such, there was no revaluation

of the assets and liabilities of the combining companies. Unless otherwise stated herein, all information with

respect to Shares refers to Shares on or since January 6, 1999 and to Paired Shares for periods before

January 6, 1999.

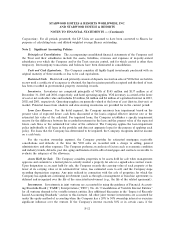

The Corporation, through its subsidiaries, is the general partner of, and held, as of December 31, 2003, an

aggregate 98.2% partnership interest in, SLC Operating Limited Partnership (the ""Operating Partnership'').

The Trust, through its subsidiaries, is the general partner of, and held an aggregate 97.3% partnership interest

in, SLT Realty Limited Partnership (the ""Realty Partnership'' and, together with the Operating Partnership,

the ""Partnerships'') as of December 31, 2003. The units of the Partnerships (""LP Units'') held by the limited

partners of the respective Partnerships are exchangeable on a one-for-one basis for Shares. At December 31,

2003, there were approximately 5.6 million LP Units outstanding (including 4.3 million LP Units held by the

F-11