Starwood 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

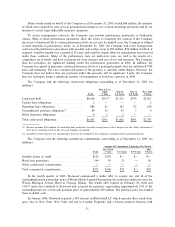

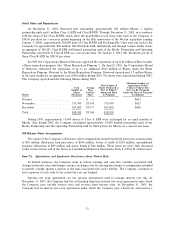

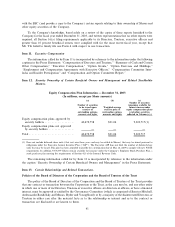

variable rate. The following table sets forth the scheduled maturities and the total fair value of the Company's

debt portfolio:

Expected Maturity or Total Fair

Transaction Date Total at Value at

At December 31, December 31, December 31,

2004 2005 2006 2007 2008 Thereafter 2003 2003

Liabilities

Fixed rate (in millions)ÏÏÏÏÏÏÏÏÏÏ $ 36 $489 $704 $756 $22 $2,050 $4,057 $4,122

Average interest rate ÏÏÏÏÏÏÏÏÏÏÏÏ 6.20%

Floating rate (in millions) ÏÏÏÏÏÏÏ $197 $114 $225 $ 8 $ 6 $ 19 $ 569 $ 569

Average interest rate ÏÏÏÏÏÏÏÏÏÏÏÏ 3.85%

Interest Rate Swaps

Fixed to variable

(in millions) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $450 $ Ì $600 $Ì $ Ì $1,050

Average pay rate ÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.07%

Average receive rate ÏÏÏÏÏÏÏÏÏÏ 7.11%

The Company uses foreign currency hedging instruments to manage exposure to foreign currency

exchange rate Öuctuations. The gains or losses on the hedging instruments are largely oÅset by gains or losses

on the underlying asset or liability, and consequently, a sudden signiÑcant change in foreign currency exchange

rates would not have a material impact on future net income or cash Öows of the hedged item. The Company

monitors its foreign currency exposure on a monthly basis to maximize the overall eÅectiveness of its foreign

currency hedge positions. Changes in the fair value of hedging instruments are classiÑed in the same manner

as changes in the underlying assets or liabilities due to Öuctuations in foreign currency exchange rates. At

December 31, 2003, the notional amount of the Company's open foreign exchange hedging contracts

protecting the value of the Company's foreign currency denominated assets and liabilities was approximately

$544 million. A hypothetical 10% change in the spot currency exchange rates would result in an increase or

decrease of approximately $59 million in the fair value of the hedges at December 31, 2003, which would be

oÅset by an opposite eÅect on the related underlying net asset or liability.

The Company enters into a derivative Ñnancial arrangement to the extent it meets the objectives

described above, and the Company does not engage in such transactions for trading or speculative purposes.

See Note 19. Derivative Financial Instruments in the notes to Ñnancial statements Ñled as part of this

Joint Annual Report and incorporated herein by reference for further description of derivative Ñnancial

instruments.

Item 8. Financial Statements and Supplementary Data.

The Ñnancial statements and supplementary data required by this Item are included in Item 15 of this

Joint Annual Report and are incorporated herein by reference.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

Not applicable

Item 9A. Controls and Procedures

The Company's management conducted an evaluation, under the supervision and with the participation

of the Company's Chief Executive OÇcer and Chief Financial OÇcer, of the eÅectiveness of the design and

operation of the Company's disclosure controls and procedures as of December 31, 2003. Based on this

evaluation, the Chief Executive OÇcer and Chief Financial OÇcer concluded that the Company's disclosure

controls and procedures are eÅective in alerting them in a timely manner to material information required to

be included in the Company's SEC reports. There has been no change in the Company's internal control over

36