Starwood 2003 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

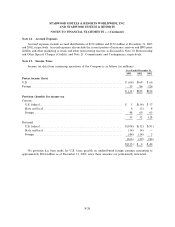

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

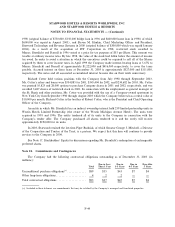

Exchangeable Units and Preferred Shares. During 1998, 6.3 million shares of Class A EPS, 5.5 million

shares of Class B EPS and approximately 800,000 limited partnership units of the Realty Partnership and

Operating Partnership (""Exchangeable Units'') were issued by the Trust in connection with the Westin

Merger. Class A EPS have a par value of $0.01 per share and are convertible on a one-for-one basis (subject

to certain adjustments) to Shares. Exchangeable Units and Class B EPS have a liquidation preference of

$38.50 per share and provide the holders with the right, for a one year period, from and after the Ñfth

anniversary of the closing date of the Westin Merger, which began on January 2, 2003, to require the

Company to redeem such shares for cash at a price of $38.50 per share. Subsequent to January 3, 2004, the

Company may choose to settle Class B EPS redemptions in cash at $38.50 per share or shares of Class A EPS

at the equivalent of $38.50 per share. Exchangeable Units may be converted to Shares on a one-for-one basis.

During 2003, no shares of Class B EPS were exchanged into shares of Class A EPS and approximately

13,000 shares of Class A EPS were exchanged into an equal number of Shares. At December 31, 2003, the

Trust had 150 million preferred shares authorized and approximately 481,000 of Class A EPS and 802,000

Exchangeable Units and Class B EPS outstanding. Through December 31, 2003, in accordance with the terms

of the Class B EPS discussed above, approximately 528,000 shares of Class B EPS were put back to the

Company for approximately $20 million. Approximately 408,000 additional Class B EPS were redeemed for

$16 million from January 1, 2004 through January 3, 2004. On January 2, 2003, Mr. Sternlicht redeemed

240,391 of these Class B EPS for $38.50 per share.

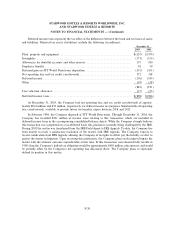

Note 18. Stock Incentive Plans

In 2002, the Company adopted the 2002 Long-Term Incentive Compensation Plan (""2002 LTIP''),

which superseded the 1999 Long Term Incentive Compensation Plan (the ""1999 LTIP'') and provides for the

purchase of Shares by Directors, oÇcers, employees, consultants and advisors, pursuant to equity award

grants. Although no additional awards will be granted under the 1999 LTIP, or the Company's 1995 Share

Option Plan (the ""1995 LTIP''), the 1999 LTIP and 1995 LTIP will continue to govern awards that have

been granted and remain outstanding under those plans. The aggregate number of Shares subject to non-

qualiÑed or incentive stock options, performance shares, restricted stock or any combination of the foregoing

which are available to be granted under the 2002 LTIP at December 31, 2003 was approximately 9.3 million.

F-38