Starwood 2003 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

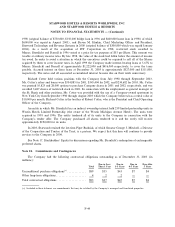

1998 (original balance of $750,000, $150,000 bridge loan in 1996 and $600,000 home loan in 1998) of which

$600,000 was repaid in August 2003), and Steven M. Hankin, Chief Marketing OÇcer and President,

Starwood Technology and Revenue Systems in 2000 (original balance of $300,000 which was repaid January

2004). As a result of the acquisition of ITT Corporation in 1998, restricted stock awarded to

Messrs. Sternlicht and Darnall in 1996 vested at a price for tax purposes of $53 per Share. This amount was

taxable at ordinary income rates. By late 1998, the value of the stock had fallen below the amount of income

tax owed. In order to avoid a situation in which the executives could be required to sell all of the Shares

acquired by them to cover income taxes, in April 1999 the Company made interest-bearing loans at 5.67% to

Messrs. Sternlicht and Darnall of approximately $1,222,000 and $416,000 respectively, to cover the taxes

payable. Accrued interest on these loans at December 31, 2003 is approximately $327,000 and $111,000,

respectively. The notes and all associated accumulated interest become due on their tenth anniversary.

Richard Cotter held various positions with the Company from July 1998 through September 2003.

Mr. Cotter's salary and bonus were $354,885 for 2001, $345,404 for 2002, and $234,682 for 2003. Mr. Cotter

was granted 10,823 and 28,000 options to purchase Company shares in 2001 and 2002, respectively, and was

awarded 3,487 shares of restricted stock in 2001. In connection with his employment as general manager of

the St. Regis and other positions, Mr. Cotter was provided with the use of a Company-owned apartment in

New York City from September 1998 through August 2003 which the Company believes has a rental value of

$10,000 per month. Richard Cotter is the brother of Robert Cotter, who is the President and Chief Operating

OÇcer of the Company.

An entity in which Mr. Sternlicht has an indirect ownership interest held 259 limited partnership units in

Westin Hotels Limited Partnership (the owner of the Westin Michigan Avenue Hotel). The units were

acquired in 1995 and 1996. The entity tendered all of its units to the Company in connection with the

Company's tender oÅer. The Company purchased all shares tendered to it and the entity will receive

approximately $190,000 for its units.

In 2003, Starwood retained the law Ñrm Piper Rudnick, of which Senator George J. Mitchell, a Director

of the Corporation and Trustee of the Trust, is a partner. We expect that this Ñrm will continue to provide

services to the Company in 2004.

See Note 17. Stockholders' Equity for discussions regarding Mr. Sternlicht's redemption of exchangeable

preferred shares.

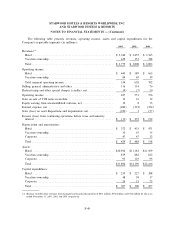

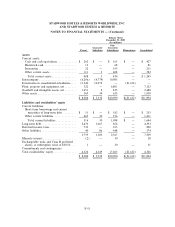

Note 21. Commitments and Contingencies

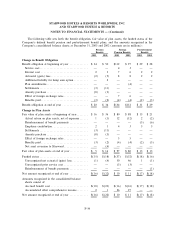

The Company had the following contractual obligations outstanding as of December 31, 2003 (in

millions):

Due in Less Due in Due in Due After

Total Than 1 Year 1-3 Years 4-5 Years 5 Years

Unconditional purchase obligations(a)ÏÏÏÏÏÏÏÏÏÏÏÏÏ $89 $35 $43 $7 $4

Other long-term obligationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4 2 2 Ì Ì

Total contractual obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $93 $37 $45 $7 $4

(a) Included in these balances are commitments that may be satisÑed by the Company's managed and franchised properties.

F-44