Starwood 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

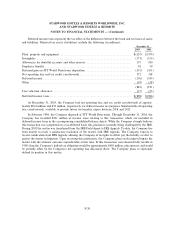

In December 2003, the FASB revised FIN 46 (""FIN 46-(R)''), delaying the eÅective date for certain

entities created before February 1, 2003 and making other amendments to clarify the application of the

guidance. In adopting FIN 46 and in anticipation of adopting FIN 46-(R), the Company has evaluated its

various variable interests to determine whether they are in VIE's. These variable interests, which generally

represent modest interests relative to the other investors in the ventures, are primarily related to the

Company's strategy to expand its role as a third-party manager of hotels and resorts, allowing the Company to

increase the presence of its lodging brands and gain additional cash Öow. The process identiÑed the following

types of variable interests: (a) subordinated loans to ventures which have typically taken the form of Ñrst or

second mortgage loans, (b) equity investments in ventures which have typically ranged from 10% to 30% of

the equity, (c) guarantees to ventures which have typically related to loan guarantees on new construction

projects that are well capitalized and which typically expire within a few years of the hotels opening and

(d) other types of contributions to ventures owning hotels to secure the management or franchise contract.

The Company also reviewed its other management and franchise agreements related to hotels that the

Company has no other investments in and concluded that such arrangements were not variable interests since

the Company is paid commensurate with the services provided and on the same level as other operating

liabilities and the hotel owners retain the right to terminate the arrangements.

Of the nearly 400 hotels that the Company manages or franchises, the Company identiÑed approximately

20 hotels that it has a variable interest in. For those ventures that the Company holds a variable interest, it

determined that the Company was not the PB and such VIE's should not be consolidated in the Company's

Ñnancial statements. The Company's outstanding loan balances exposed to losses as a result of its involvement

in VIE's totaled $69 million at December 31, 2003. Equity investments and other types of investments related

to these VIE's totaled $24 million and $21 million, respectively, at December 31, 2003. Information

concerning the Company's exposure to loss on loan guarantees and commitments to fund other types of

contributions is summarized in Note 21. Commitments and Contingencies.

The Company has adopted FIN 46 for entities created subsequent to January 31, 2003 as of

December 31, 2003 and will adopt FIN 46-(R) as of the end of the interim period ended March 31, 2004. The

adoption of FIN 46 did not result in the consolidation of any VIE's, nor is the adoption of FIN 46-(R)

expected to result in the consolidation of any VIE's. The impact of adopting FIN 46-(R) is not expected to

result in the identiÑcation of any additional interests in variable interest entities.

In November 2002, the FASB issued FIN No. 45 ""Guarantor Accounting and Disclosure Requirements

for Guarantees, Including Indirect Guarantees of Indebtedness of Others.'' This interpretation modiÑes the

accounting treatment for certain guarantees and is eÅective for all guarantees issued or modiÑed after

December 31, 2002. The new disclosure rules are eÅective for interim or annual periods ending after

December 15, 2002. The Company has incorporated the disclosure requirements into this Ñling and will be

monitoring its new guarantees for compliance. FIN No. 45 did not have a material impact on the Company.

In July 2002, the FASB issued SFAS No. 146, ""Accounting for Costs Associated with Exit or Disposal

Activities''. This statement addresses Ñnancial accounting and reporting for costs associated with exit or

disposal activities. SFAS No. 146 is eÅective for exit or disposal activities that are initiated after Decem-

ber 31, 2002. The adoption of SFAS No. 146 did not have and the Company believes will not have a material

impact on its consolidated Ñnancial position or cash Öows; however it may aÅect the timing of recognizing

future restructuring costs.

EÅective January 1, 2002, the Company adopted SFAS No. 141, ""Business Combinations,'' and SFAS

No. 142, ""Goodwill and Other Intangible Assets.'' In accordance with this guidance, the Company has ceased

amortizing goodwill and intangible assets with indeÑnite lives. Intangible assets with Ñnite lives continue to

amortize on a straight-line basis over their respective useful lives. Adoption of this standard did not result in

any impairment charges.

F-19