Starwood 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

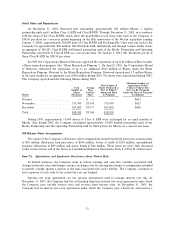

Stock Sales and Repurchases

At December 31, 2003, Starwood had outstanding approximately 202 million Shares, 1 million

partnership units and 1 million Class A EPS and Class B EPS. Through December 31, 2003, in accordance

with the terms of the Class B EPS, which allow the shareholders to put these units back to the Company at

$38.50 per share for a one-year period beginning on the Ñfth anniversary of the Westin acquisition (ending

January 3, 2004), approximately 528,000 units of Class B EPS and Exchangeable Units were put back to the

Company for approximately $20 million. Mr. Sternlicht held, individually and through various family trusts,

an aggregate of 240,391 Class B EPS and limited partnership units of the Realty Partnership and Operating

Partnership convertible to Class B EPS on a one-to-one basis. On January 2, 2003, Mr. Sternlicht put all of

these Class B EPS for $38.50 per share.

In 1998, the Corporation's Board of Directors approved the repurchase of up to $1 billion of Shares under

a Share repurchase program (the ""Share Repurchase Program''). On April 2, 2001, the Corporation's Board

of Directors authorized the repurchase of up to an additional $500 million of Shares under the Share

Repurchase Program. Pursuant to the Share Repurchase Program, Starwood repurchased 3.2 million Shares

in the open market for an aggregate cost of $96 million during 2001. No shares were repurchased during 2002.

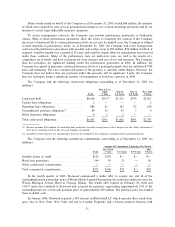

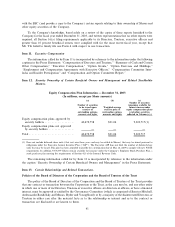

The Company repurchased the following Shares during 2003:

Maximum Number (or

Total Number of Approximate Dollar

Total Average Shares Purchased as Value) of Shares that

Number of Price Part of Publicly May Yet Be Purchased

Shares Paid for Announced Plans Under the Plans or Programs

Period Purchased Share or Programs (in millions)

October ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì $ Ì Ì $633

November ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 315,700 $33.43 315,700 $623

December ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 503,000 $33.71 503,000 $606

TotalÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 818,700 $33.60 818,700

During 2003, approximately 13,000 shares of Class A EPS were exchanged for an equal number of

Shares. Also during 2003, the Company exchanged approximately 13,000 limited partnership units of the

Realty Partnership and the Operating Partnership held by third parties for Shares on a one-for-one basis.

OÅ-Balance Sheet Arrangements

The nature of the Company's oÅ-balance sheet arrangements include beneÑcial interest in securitizations

of $50 million, third-party loan guarantees of $144 million, letters of credit of $129 million, unconditional

purchase obligations of $89 million and surety bonds of $46 million. These items are more fully discussed

earlier in this section and in the Notes to Consolidated Financial Statements, Item 8 of Part II of this report.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

In limited instances, the Company seeks to reduce earnings and cash Öow volatility associated with

changes in interest rates and foreign currency exchange rates by entering into Ñnancial arrangements intended

to provide a hedge against a portion of the risks associated with such volatility. The Company continues to

have exposure to such risks to the extent they are not hedged.

Interest rate swap agreements are the primary instruments used to manage interest rate risk. At

December 31, 2003, the Company had Ñve outstanding long-term interest rate swap agreements under which

the Company pays variable interest rates and receives Ñxed interest rates. At December 31, 2003, the

Company had no interest rate swap agreements under which the Company pays a Ñxed rate and receives a

35