Starwood 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

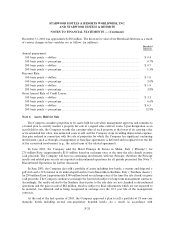

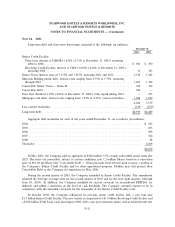

ended December 31, 2002. As discussed above, in connection with the 2003 securitizations, the Company

repurchased all of the existing receivables under the 2002 Note Sales.

During 2001, the Company sold, without recourse, through a bankruptcy-remote QSPE, the beneÑcial

interest in $226 million of notes receivable originated in connection with the sale of VOIs (the ""2001

Securitizations''). The Company continues to service the sold notes. This sale and servicing arrangement was

negotiated on an arms-length basis based on market conditions. The Company's retained interests in the 2001

Securitizations is in the form of a security (the ""2001 BeneÑcial Interests'') that is equivalent to over-

collateralization and an interest-only strip, which provides credit enhancement to the third party investors in

the QSPE. The Company's right to receive cash Öows from the 2001 BeneÑcial Interests is limited to cash

available after paying the QSPE's Ñnancing expenses, program fees and absorbing the QSPE's credit losses

related to the sold notes. Gains from the 2001 Securitizations totaled $10 million for the year ended

December 31, 2001.

At December 31, 2003, $100 million of principal amounts of notes is outstanding under the 2001

Securitizations and an additional $176 million of principal amounts of notes is outstanding under the 2003

Securitization. Delinquencies of more than 90 days on these receivables at December 31, 2003 amounted to

approximately $3 million and $1 million for the 2001 and 2003 Securitizations, respectively.

Under the 2003 and 2001 Securitizations, the Company has an option to repurchase defaulted notes (as

deÑned) included in the transactions for their outstanding principal amounts. The Company has been able to

resell vacation ownership interests underlying the loans that it repurchased under these provisions without

incurring signiÑcant losses, resulting in additional gains of approximately $6 million and $2 million in 2003 and

2002, respectively.

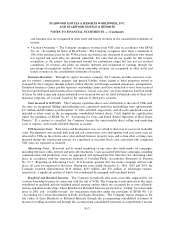

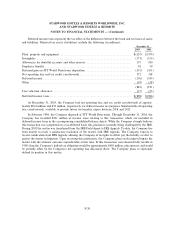

At the time of each securitization or notes sale and at the end of each Ñnancial reporting period, the

Company estimates the fair value of its BeneÑcial and Retained Interests using a discounted cash Öow model.

All assumptions used in the models are reviewed and updated, if necessary, based on current trends and

historical experience. The BeneÑcial and Retained Interests are classiÑed as either ""trading'' or ""available-for-

sale'' securities in accordance with the provisions of SFAS No. 115 ""Accounting for Certain Investments in

Debt and Equity Securities'' and SFAS No. 140. The BeneÑcial Interests from the 2001 Securitizations are

classiÑed as trading, with changes in fair value reported through operating results. The BeneÑcial Interests

from the 2003 Securitizations are classiÑed as available-for-sale, with changes in fair value reported through

equity in other comprehensive income. During 2002, the Company changed its assumption for the 2001

Securitizations discount rate from the initial rate of 16% to 14%, bringing its rates in line with comparable

industry assumptions. The change did not have a material impact on the BeneÑcial Interest balance.

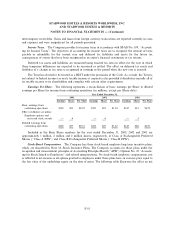

The Company has completed a sensitivity analysis on the net present value of the BeneÑcial Interests to

measure the change in value associated with independent changes in individual key variables. The methodol-

ogy used applied unfavorable changes that would be considered statistically signiÑcant for the key variables of

prepayment rate, discount rate and expected gross credit losses. The net present value of BeneÑcial Interests at

F-22