Starwood 2003 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

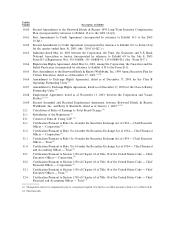

Exhibit

Number Description of Exhibit

10.11 Form of Trademark License Agreement, dated as of December 10, 1997, between Starwood Capital

and the Trust (incorporated by reference to Exhibit 10.22 to the 1997 Form 10-K).

10.12 Exchange Rights Agreement, dated as of January 1, 1995, among the Trust, the Corporation, Realty

Partnership, Operating Partnership and the Starwood Partners (incorporated by reference to

Exhibit 2B to the Trust's and the Corporation's Joint Current Report on Form 8-K dated January 31,

1995 (the ""Formation Form 8-K'')).

10.13 Registration Rights Agreement, dated as of January 1, 1995, among the Trust, the Corporation and

Starwood Capital (incorporated by reference to Exhibit 2C to the Formation Form 8-K).

10.14 Exchange Rights Agreement, dated as of June 3, 1996, among the Trust, the Corporation, Realty

Partnership, Operating Partnership, Philadelphia HIR Limited Partnership and Philadelphia HSR

Limited Partnership (incorporated by reference to Exhibit 10.1 to the Trust's and the Corporation's

Joint Quarterly Report on Form 10-Q for the quarterly period ended June 30, 1996 (the ""1996

Form 10-Q2'')).

10.15 Registration Rights Agreement, dated as of June 3, 1996, among the Trust, the Corporation and

Philadelphia HSR Limited Partnership (incorporated by reference to Exhibit 10.2 to the 1996

Form 10-Q2).

10.16 Units Exchange Rights Agreement, dated as of February 14, 1997, by and among, inter alia, the

Trust, the Corporation, Realty Partnership, Operating Partnership and the Starwood Partners

(incorporated by reference to Exhibit 10.34 to the 1997 Form 10-K).

10.17 Class A Exchange Rights Agreement, dated as of February 14, 1997, by and among, inter alia, the

Trust, the Corporation, Operating Partnership and the Starwood Partners (incorporated by reference

to Exhibit 10.35 to the 1997 Form 10-K).

10.18 Exchange Rights Agreement, dated as of January 2, 1998, among, inter alia, the Trust, Realty

Partnership and Woodstar (incorporated by reference to Exhibit 10.50 to the 1997 Form 10-K).

10.19 Exchange Rights Agreement, dated as of January 2, 1998, among, inter alia, the Corporation,

Operating Partnership and Woodstar (incorporated by reference to Exhibit 10.51 to the 1997

Form 10-K).

10.20 Registration Rights Agreement, dated as of January 2, 1998, among, inter alia, the Trust, the

Corporation, and Woodstar (incorporated by reference to Exhibit 10.52 to the 1997 Form 10-K).

10.21 Pledge and Security Agreement, dated as of February 23, 1998, executed and delivered by the Trust,

the Corporation and the other Pledgors party thereto, in favor of Bankers Trust Company as

Collateral Agent (incorporated by reference to Exhibit 10.63 to the 1997 Form 10-K).

10.22 Second Amended and Restated Senior Secured Note Agreement, dated December 30, 1999, among

the Corporation, the Trust, the guarantors listed therein, the lenders listed therein, Lehman

Commercial Paper Inc., as Arranger and Administrative Agent, and Alex Brown and Chase

Securities Inc., as Syndication Agents (incorporated by reference to Exhibit 10.46 to the 1999

Form 10-K).

10.23 Loan Agreement, dated as of February 23, 1998, between the Trust and the Corporation, together

with Promissory Note executed in connection therewith, by the Corporation to the order of the Trust,

in the principal amount of $3,282,000,000 (incorporated by reference to Exhibit 10.65 to the 1997

Form 10-K).

10.24 Loan Agreement, dated as of February 23, 1998, between the Trust and the Corporation, together

with Promissory Note executed in connection therewith, by the Corporation to the order of the Trust,

in the principal amount of $100,000,000 (incorporated by reference to Exhibit 10.66 to the 1997

Form 10-K).

10.25 Loan Agreement, dated as of February 23, 1998, between the Trust and the Corporation, together

with Promissory Note executed in connection therewith, by the Corporation to the order of the Trust,

in the principal amount of $50,000,000 (incorporated by reference to Exhibit 10.67 to the 1997

Form 10-K).