Starwood 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other. In addition to the put rights under the Series B Convertible Senior Notes, the Company has

approximately $233 million of its outstanding debt maturing in 2004. Based upon the current level of

operations, management believes that the Company's cash Öow from operations, together with available

borrowings under the Revolving Credit Facility (approximately $856 million at December 31, 2003), available

borrowings from international revolving lines of credit (approximately $44 million at December 31, 2003), and

capacity for additional borrowings will be adequate to meet anticipated requirements for scheduled maturities,

dividends, working capital, capital expenditures, marketing and advertising program expenditures, other

discretionary investments, interest and scheduled principal payments for the foreseeable future. However,

Starwood has a substantial amount of indebtedness and had a working capital deÑciency of $399 million at

December 31, 2003. There can be no assurance that the Company will be able to reÑnance its indebtedness as

it becomes due and, if reÑnanced, on favorable terms, nor can there be assurance that the Company's business

will continue to generate cash Öow at or above historical levels or that currently anticipated results will be

achieved.

The Company maintains non-U.S.-dollar-denominated debt, which provides a hedge of the Company's

international net assets and operations but also exposes its debt balance to Öuctuations in foreign currency

exchange rates. During the years ended December 31, 2003 and 2002, the eÅect of changes in foreign currency

exchange rates was a net increase in debt of approximately $54 million and $135 million, respectively. The

Company's debt balance is also aÅected by changes in interest rates as a result of the Company's Fair Value

Swaps. The fair market value of the Fair Value Swaps is recorded as an asset or liability and as the Fair Value

Swaps are deemed to be eÅective, an adjustment is recorded against the corresponding debt. At December 31,

2003, the Company's debt included an increase of approximately $57 million related to the unamortized

premium on terminated Fair Value Swaps and the fair market value of current Fair Value Swap assets. At

December 31, 2002 the Company's debt included an increase of approximately $75 million related to fair

value swap liabilities.

If Starwood is unable to generate suÇcient cash Öow from operations in the future to service the

Company's debt, the Company may be required to sell additional assets, reduce capital expenditures, reÑnance

all or a portion of its existing debt or obtain additional Ñnancing. The Company's ability to make scheduled

principal payments, to pay interest on or to reÑnance the Company's indebtedness depends on its future

performance and Ñnancial results, which, to a certain extent, are subject to general conditions in or aÅecting

the hotel and vacation ownership industries and to general economic, political, Ñnancial, competitive,

legislative and regulatory factors beyond the Company's control, including the severity and duration of the

current economic downturn.

On May 6, 2003, Standard & Poor's announced its decision to downgrade the Company's Credit Rating

to BB° (non-investment grade with a stable outlook) from BBB¿ (investment grade rating on Credit Watch

with negative implications). The downgrading of the Company's credit rating may result in higher borrowing

costs on future Ñnancings. On January 7, 2004, Moody's Investor Services and Standard & Poor's placed the

Company's Ba1 (non-investment grade) and BB° corporate credit ratings on review/watch for a possible

downgrade. The review/watch was prompted by the Company's announcement that it had invested $200 mil-

lion in Le Meridien's senior debt and would be in discussions to negotiate the potential recapitalization of Le

Meridien.

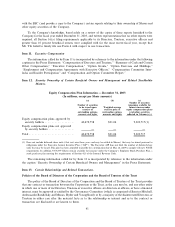

At December 31, 2003, approximately 800,000 shares of Class B EPS and Exchangeable Units were

outstanding, aggregating $31 million (valued at $38.50 per share). Approximately 408,000 additional Class B

EPS were redeemed for $16 million from January 1, 2004 through January 3, 2004. Subsequent to January 3,

2004, if Class B EPS are put to the Company, the Company may settle the put in cash at $38.50 per share or

Class A EPS at $38.50 per share.

In 2002, the Company shifted from a quarterly distribution to an annual distribution. A distribution of

$0.84 per Share, was paid in January 2004 and January 2003 to shareholders of record as of December 31,

2003 and 2002, respectively.

34