Starwood 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

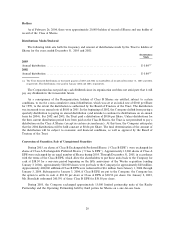

Holders

As of February 26, 2004, there were approximately 20,000 holders of record of Shares and one holder of

record of the Class A Shares.

Distributions Made/Declared

The following table sets forth the frequency and amount of distributions made by the Trust to holders of

Shares for the years ended December 31, 2003 and 2002:

Distributions

Made

2003

Annual distribution ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.84(a)

2002

Annual distribution ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.84(a)

(a) The Trust declared distributions in the fourth quarter of 2003 and 2002 to shareholders of record on December 31, 2003 and 2002,

respectively. The distributions were paid in January 2004 and 2003, respectively.

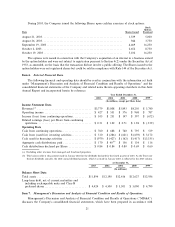

The Corporation has not paid any cash dividends since its organization and does not anticipate that it will

pay any dividends in the foreseeable future.

As a consequence of the Reorganization, holders of Class B Shares are entitled, subject to certain

conditions, to receive a non-cumulative annual distribution, which was set at an initial rate of $0.60 per Share

for 1999, to the extent the distribution is authorized by the Board of Trustees of the Trust. The distribution

was increased to an annual rate of $0.80 in 2001. In the beginning of 2002, the Company shifted from paying a

quarterly distribution to paying an annual distribution (and intends to continue its distributions on an annual

basis for 2004). For 2002 and 2003, the Trust paid a distribution of $0.84 per Share. Unless distributions for

the then current distribution period have been paid on the Class B Shares, the Trust is not permitted to pay a

distribution on the Class A Shares (except in certain circumstances). At this time, the Company anticipates

that the 2004 distributions will be held constant at $0.84 per Share. The Ñnal determination of the amount of

the distribution will be subject to economic and Ñnancial conditions, as well as approval by the Board of

Trustees of the Trust.

Conversion of Securities; Sale of Unregistered Securities

During 2003, no shares of Class B Exchangeable Preferred Shares (""Class B EPS'') were exchanged for

shares of Class A Exchangeable Preferred Shares (""Class A EPS''). Approximately 13,000 shares of Class A

EPS were exchanged for an equal number of Shares during 2003. Through December 31, 2003, in accordance

with the terms of the Class B EPS, which allow the shareholders to put these units back to the Company for

cash at $38.50 for a one-year period beginning on the Ñfth anniversary of the Westin acquisition (ending

January 3, 2004), approximately 528,000 shares were put back to the Company for approximately $20 million.

Approximately 408,000 additional Class B EPS were redeemed for $16 million from January 1, 2004 through

January 3, 2004. Subsequent to January 3, 2004, if Class B EPS are put to the Company, the Company has

the option to settle in cash at $38.50 per share or Class A EPS at $38.50 per share. On January 2, 2003,

Mr. Sternlicht redeemed 240,391 of these Class B EPS for $38.50 per share.

During 2003, the Company exchanged approximately 13,000 limited partnership units of the Realty

Partnership and the Operating Partnership held by third parties for Shares on a one-for-one basis.

20