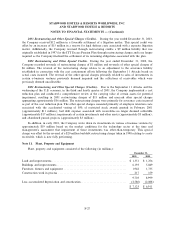

Starwood 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

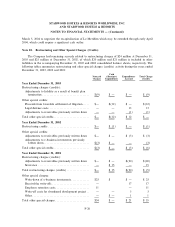

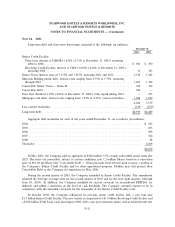

operated together with one of the non-core domestic hotels and is now closed and under review for alternative

use and a $2 million charge related to an impairment of an investment.

During 2002, the Company sold two hotels for net proceeds of $51 million. The Company recorded a net

loss on these sales of $3 million in 2002.

In September 2002, the Company sold its 2% investment in Interval International, a timeshare exchange

company. The Company received gross proceeds of approximately $8 million as a result of this sale and

recorded a pretax gain of approximately $6 million.

Due to the September 11, 2001 terrorist attacks in New York, Washington, D.C. and Pennsylvania (the

""September 11 Attacks'') and the weakening of the U.S. economy, the Company conducted a comprehensive

review of the carrying value of certain assets for potential impairment. As a result, in the fourth quarter of

2001 the Company recorded a net charge totaling $57 million relating primarily to the impairment of certain

investments.

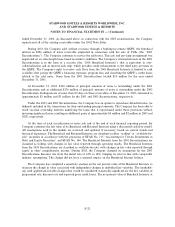

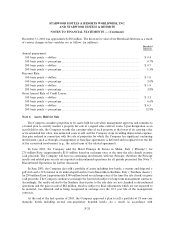

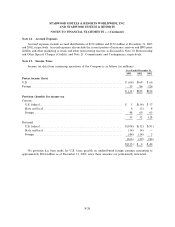

Note 5. Asset Securitizations

At December 31, 2003 and 2002, the Company has approximately $119 million and $157 million,

respectively, in vacation ownership notes receivable, representing receivables from over 20,000 customers.

From time to time, the Company securitizes or sells these vacation ownership notes receivable.

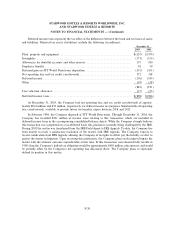

The Company accounts for its notes receivable securitizations and sales as transactions in accordance

with SFAS No. 140. The Company accounted for both of the transactions described below as SFAS No. 140

sales.

During 2003, the Company sold, without recourse, through a bankruptcy-remote qualiÑed special purpose

entity (the ""QSPE''), the beneÑcial interest in $181 million of notes receivable originated in connection with

the sale of VOIs (the ""2003 Securitization''). The Company continues to service the notes. This sale and

servicing arrangement was negotiated on an arms-length basis based on market conditions. The Company has

retained interests in the 2003 Securitization in the form of a security (the ""BeneÑcial Interests'') that is

equivalent to over-collateralization and an interest-only strip, which provides credit enhancement to the third

party investors in the QSPE. The Company's right to receive cash Öows from the BeneÑcial Interests is limited

to cash available after paying the QSPE's Ñnancing expenses, program fees and absorbing the QSPE's credit

losses related to the sold notes. Gains from the 2003 Securitization totaled $9 million for the year ended

December 31, 2003. In connection with the 2003 Securitization, the Company repurchased all existing

receivables under the 2002 Note Sales described below.

The key assumptions used in measuring the fair value of the BeneÑcial Interests at the time of the 2003

Securitization were as follows: discount rate of 14%; annual prepayments, which yields an average expected

life of prepayable notes receivable of 89 months; and expected gross mortgage balance defaulting as a

percentage of the total initial pool of 17.8%.

During 2002, the Company sold, without recourse, through a special purpose entity (the ""SPE''),

$133 million of notes receivable originated in connection with the sale of VOIs (""the 2002 Note Sales''). The

Company continued to service the sold notes. This sale and servicing arrangement was negotiated on an arms-

length basis based on market conditions. The Company retained an interest (the ""Retained Interests'') in the

sold notes that was economically equivalent to over-collateralization and an interest-only strip that provides

credit enhancement to the third-party purchaser of the notes. The Company's right to receive cash Öows from

the Retained Interests was limited to cash available after paying the SPE's Ñnancing expenses, program fees

and absorbing credit losses related to the sold notes. Net cash proceeds received from this sale of notes

receivable were approximately $120 million. Gains from the sale of these notes totaled $14 million for the year

F-21