Starwood 2003 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

historical rates of return and Company and investment expert expectations for investment performance over

approximately a ten year period.

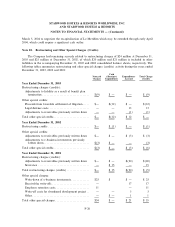

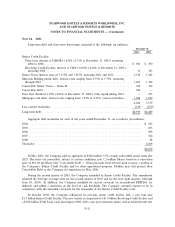

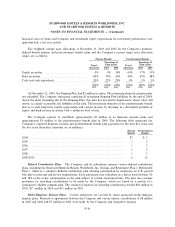

The weighted average asset allocations at December 31, 2003 and 2002 for the Company's domestic

deÑned beneÑt pension and postretirement beneÑt plans and the Company's current target asset allocation

ranges are as follows:

Pension BeneÑts Postretirement BeneÑts

Percentage of Percentage of

Plan Assets Plan Assets

Target Target

Allocation 2003 2002 Allocation 2003 2002

Equity securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0% 0% 26% 60% 57% 51%

Debt securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 80% 79% 45% 40% 42% 48%

Cash and cash equivalents ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20% 21% 29% 0% 1% 1%

100% 100% 100% 100% 100% 100%

At December 31, 2003, the Ongoing Plan had $5 million in assets. The remaining domestic pension plans

are unfunded. The Company anticipates satisfying all remaining Ongoing Plan liabilities by the end of 2004.

Given the short remaining life of the Ongoing Plan, this plan has invested in liquid assets whose value will

mirror, as closely as possible, the liabilities of the plan. The investment objective of the postretirement beneÑt

plan is to seek long-term capital appreciation and current income by investing in a diversiÑed portfolio of

equity and Ñxed income securities with a moderate level of risk.

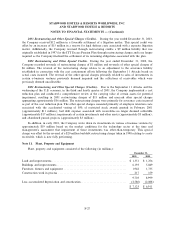

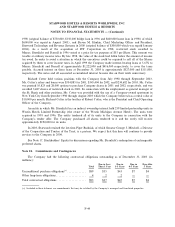

The Company expects to contribute approximately $2 million to its domestic pension plans and

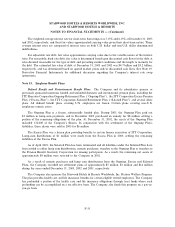

approximately $3 million to the postretirement beneÑt plan in 2004. The following table represents the

Company's expected domestic pension and postretirement beneÑt plan payments for the next Ñve years and

the Ñve years thereafter (amounts are in millions):

Pension Postretirement

BeneÑts BeneÑts

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $7 $ 3

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1 3

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1 3

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1 3

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1 3

2009-2013 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6 12

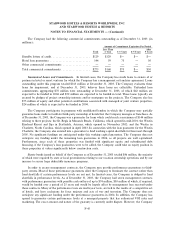

DeÑned Contribution Plans. The Company and its subsidiaries sponsor various deÑned contribution

plans, including the Starwood Hotels & Resorts Worldwide, Inc. Savings and Retirement Plan (""Retirement

Plan''), which is a voluntary deÑned contribution plan allowing participation by employees on U.S. payroll

who meet certain age and service requirements. Each participant may contribute on a pretax basis between 1%

and 18% of his or her compensation to the plan subject to certain maximum limits. The plan also contains

provisions for matching contributions to be made by the Company, which are based on a portion of a

participant's eligible compensation. The amount of expense for matching contributions totaled $18 million in

2003, $17 million in 2002 and $15 million in 2001.

Multi-Employer Pension Plans. Certain employees are covered by union sponsored multi-employer

pension plans. Pursuant to agreements between the Company and various unions, contributions of $8 million

in 2003 and 2002 and $7 million in 2001 were made by the Company and charged to expense.

F-36