Starwood 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

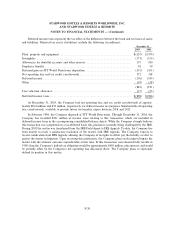

recorded a $25 million gain resulting from an adjustment to the Company's tax basis in ITT World

Directories, a subsidiary which was disposed of in early 1998 through a tax deferred reorganization. The

increase in the tax basis has the eÅect of reducing the deferred tax charge recorded on the disposition in 1998.

This gain also included the reversal of $5 million (after tax) of liabilities set up in conjunction with the sale of

the former gaming business that are no longer required as the related contingencies have been resolved.

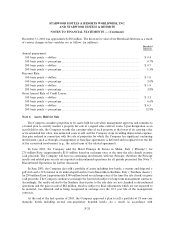

Note 8. Goodwill and Intangible Assets

Prior to the adoption of SFAS No. 142, goodwill and trademarks and trade names were amortized on a

straight-line basis over a 40-year period. EÅective January 1, 2002, goodwill and trademarks and trade names,

which are deemed intangible assets with an indeÑnite life, were no longer amortized. Intangible assets

associated with management and franchise contracts are amortized on a straight-line basis over the initial life

of the respective contract.

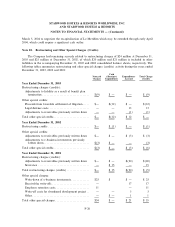

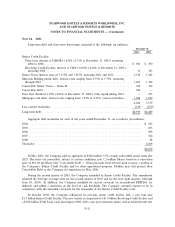

The changes in the carrying amount of goodwill for the year ended December 31, 2003 are as follows (in

millions):

Vacation

Hotel Ownership

Segment Segment Total

Balance at January 1, 2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,959 $241 $2,200

Settlement of tax contingency ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1) Ì (1)

Cumulative translation adjustment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 24 Ì 24

Asset dispositions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (113) Ì (113)

Balance at December 31, 2003.ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,869 $241 $2,110

Intangible assets consisted of the following (in millions):

December 31,

2003 2002

Trademarks and trade names ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $226 $226

Management and franchise agreementsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 168 147

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 59 64

453 437

Accumulated amortization ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (75) (67)

$378 $370

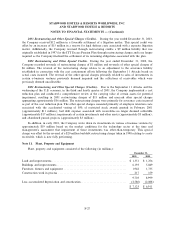

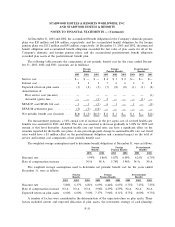

Amortization expense of $13 million, $13 million and $12 million, respectively, related to intangible

assets with Ñnite lives was recorded during the years ended December 31, 2003, 2002 and 2001. Amortization

expense relating to these assets is expected to be at least $13 million in each of the Ñscal years 2004 through

2009.

Note 9. Other Assets

Contractual Obligations. On December 30, 2003, the Company together with Lehman Brothers

Holdings Inc. (""Lehman Brothers''), announced the acquisition of all of the outstanding senior debt

(approximately $1.3 billion), at a discount, of Le Meridien Hotels and Resorts Ltd. (""Le Meridien''). The

Company funded its $200 million share of this acquisition through a high yield junior participation in the debt.

As part of this funding, Lehman Brothers and the Company have entered into an exclusive agreement through

F-25