Starwood 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Discontinued Operations

For the years ended 2003 and 2002, loss from discontinued operations represents the results of the Hotel

Principe di Savoia in Milan, Italy (""Principe''), net of $7 million and $15 million, of allocated interest

expense, respectively. The Company sold the Principe with no continuing involvement on June 30, 2003. The

gain on dispositions for 2003 consists of $194 million (pre-tax) of gains recorded in connection with the sale of

the Principe and the reversal of a $52 million (pre-tax) accrual relating to the Company's gaming businesses

disposed of in 1999 and 2000 which are no longer required as the related contingencies have been resolved.

During 2002, the Company recorded an after tax gain of $109 million from discontinued operations

primarily related to the issuance of new Internal Revenue Service (""IRS'') regulations in early 2002, which

allowed the Company to recognize a $79 million tax beneÑt from a tax loss on the 1999 sale of the former

gaming business. The tax loss was previously disallowed under the old regulations. In addition, the Company

recorded a $25 million gain resulting from an adjustment to the Company's tax basis in ITT World

Directories, a subsidiary which was disposed of in early 1998 through a tax deferred reorganization. The

increase in the tax basis has the eÅect of reducing the deferred tax charge recorded on the disposition in 1998.

This gain also included the reversal of $5 million (after tax) of liabilities set up in conjunction with the sale of

the former gaming business that are no longer required as the related contingencies have been resolved.

Year Ended December 31, 2002 Compared with Year Ended December 31, 2001

Continuing Operations

The Company's operating results for the year ended December 31, 2002 were signiÑcantly impacted by

the weakened worldwide economic environment, which resulted in a dramatic slowdown in business and

transient travel. The decrease in business transient demand, when compared to the same period of 2001, had

an adverse impact on the Company's majority owned hotels, many of which are located in major urban

markets.

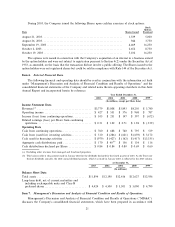

Revenues. Total revenues, including other revenues from managed and franchised properties, were

$4.588 billion, a 1.0% decrease from 2001 levels. Revenues from the Company's owned, leased and

consolidated joint venture hotels decreased 3.4% to $3.190 billion for the year ended December 31, 2002 when

compared to $3.301 billion in the corresponding period of 2001, partially oÅset by a 4.4% increase in other

hotel and leisure revenues to $618 million for the year ended December 31, 2002 when compared to

$592 million in the corresponding period of 2001.

The decrease in revenues from owned, leased and consolidated joint venture hotels is due primarily to

decreased revenues at the Company's Same-Store Owned Hotels oÅset in part by revenues generated by the

W Times Square, which opened in late December 2001, the Westin Dublin, which opened in September 2001,

the W Lakeshore Drive in Chicago, Illinois which reopened in October 2001 after a signiÑcant renovation and

repositioning, and the Sheraton Centre Toronto in Toronto, Canada of which the Company acquired the

remaining 50% not previously owned in April 2001. Revenues at the Company's Same-Store Owned Hotels

decreased 6.1% to $2.971 billion for the year ended December 31, 2002 when compared to the same period of

2001 due primarily to a decrease in REVPAR. REVPAR at the Company's Same-Store Owned Hotels

decreased 6.0% to $94.76 for the year ended December 31, 2002 when compared to the corresponding 2001

period. The decrease in REVPAR at these Same-Store Owned Hotels was attributed to a decrease in

occupancy to 63.5% in the year ended December 31, 2002 when compared to 65.1% in the same period of 2001

and a decrease in ADR at these Same-Store Owned Hotels. ADR decreased 3.6% to $149.32 for the year

ended December 31, 2002 compared to $154.86 for the corresponding 2001 period. REVPAR at Same-Store

Owned Hotels in North America decreased 6.0% for the year ended December 31, 2002 when compared to

the same period of 2001. As discussed above, the decrease in REVPAR and revenues from owned, leased and

consolidated joint venture hotels in North America was primarily due to the decline in business transient

demand as a result of the weakened global economies. REVPAR at the Company's international Same-Store

Owned Hotels, which decreased by 6.0% for the year ended December 31, 2002 when compared to the same

period of 2001, was also impacted by weakened global economies, the unfavorable eÅect of foreign currency

translation and adverse political and economic conditions. REVPAR for Same-Store Owned Hotels in Europe

27