Starwood 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.allowed the Company to recognize a $79 million tax beneÑt from a tax loss on the 1999 sale of the former

gaming business. The tax loss was previously disallowed under the old regulations. In addition, the Company

recorded a $25 million gain resulting from an adjustment to the Company's tax basis in ITT World

Directories, a subsidiary which was disposed of in early 1998 through a tax deferred reorganization. The

increase in the tax basis has the eÅect of reducing the deferred tax charge recorded on the disposition in 1998.

This gain also included the reversal of $5 million (after tax) of liabilities set up in conjunction with the sale of

the former gaming business that are no longer required as the related contingencies have been resolved.

LIQUIDITY AND CAPITAL RESOURCES

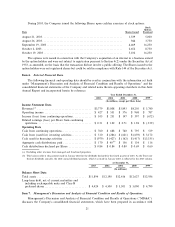

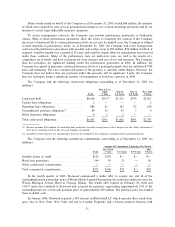

Cash From Operating Activities

Cash Öow from operating activities is the principal source of cash used to fund the Company's operating

expenses, interest payments on debt, maintenance capital expenditures and distribution payments by the

Trust. The Company anticipates that cash Öow provided by operating activities will be suÇcient to service

these cash requirements. In 2002, the Company shifted from a quarterly distribution to an annual distribution,

and declared a distribution of $0.84 per Share to shareholders of record on December 31, 2002 and 2003. The

Company paid the 2002 distribution in January 2003 and the 2003 distribution in January 2004. The Company

believes that existing borrowing availability together with capacity from additional borrowings and cash from

operations will be adequate to meet all funding requirements for the Company's operating expenses, interest

payments on debt, maintenance capital expenditures and distribution payments by the Trust for the

foreseeable future.

Cash Used for Investing Activities

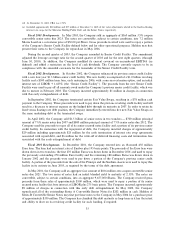

Contractual Obligations. On December 30, 2003, the Company and Lehman Brothers announced the

acquisition of all of the outstanding senior debt (approximately $1.3 billion), at a discount, of Le Meridien.

The Company funded its $200 million share of the acquisition through a high yield junior participation in the

debt. As part of this funding, Lehman Brothers and the Company have entered into an exclusive agreement

through March 5, 2004 to negotiate the recapitalization of Le Meridien which may be extended through early

April 2004. A recapitalization transaction could require a signiÑcant cash outlay by the Company.

In limited cases, the Company has made loans to owners of or partners in hotel or resort ventures for

which the Company has a management or franchise agreement. Loans outstanding under this program totaled

$163 million at December 31, 2003. The Company evaluates these loans for impairment, and at December 31,

2003, believes these loans are collectible. Unfunded loan commitments aggregating $70 million were

outstanding at December 31, 2003, of which $42 million are expected to be funded in 2004 and $52 million are

expected to be funded in total. These loans typically are secured by pledges of project ownership interests

and/or mortgages on the projects. The Company also has $75 million of equity and other potential

contributions associated with managed or joint venture properties, $24 million of which is expected to be

funded in 2004.

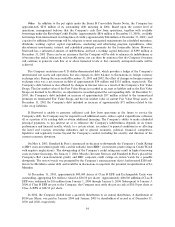

The Company participates in programs with unaÇliated lenders in which the Company may partially

guarantee loans made to facilitate third-party ownership of hotels that the Company manages or franchises. As

of December 31, 2003, the Company was a guarantor for loans which could reach a maximum of $144 million

relating to three projects: the St. Regis in Monarch Beach, California, which opened in mid-2001; the Westin

Kierland Resort and Spa in Scottsdale, Arizona, which opened in November 2002; and the Westin in

Charlotte, North Carolina, which opened in April 2003. In connection with the loan guarantee for the Westin

Charlotte, the Company also entered into a guarantee to fund working capital shortfalls for this resort through

2005. No signiÑcant fundings are anticipated under this working capital guarantee. The Company does not

anticipate any funding under the remaining loan guarantees in 2004, as all projects are well capitalized.

Furthermore, since each of these properties was funded with signiÑcant equity and subordinated debt

Ñnancing, if the Company's loan guarantees were to be called, the Company could take an equity position in

these properties at values signiÑcantly below construction costs.

30