Starwood 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

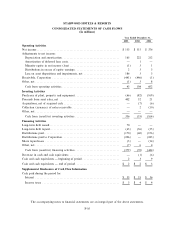

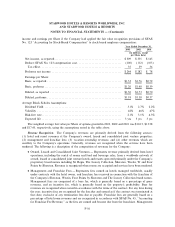

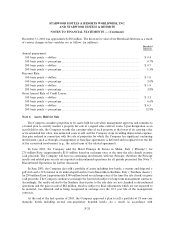

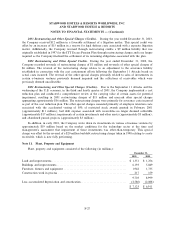

Net income, basic earnings per Share and diluted earnings per Share for the years ended December 31,

2003, 2002 and 2001, respectively, adjusted to exclude amortization expense no longer required due to the

adoption of SFAS No. 142, are as follows (net of tax, in millions, except per Share data):

Year Ended December 31,

2003 2002 2001

Reported net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 309 $ 355 $ 145

Add back: goodwill amortizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 57

Add back: trademarks and trade names amortizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 5

Adjusted net incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 309 $ 355 $ 207

Reported earnings per Share Ì basic ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1.53 $1.76 $0.72

Add back: goodwill amortizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 0.28

Add back: trademarks and trade names amortizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 0.03

Adjusted earnings per Share Ì basic ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1.53 $1.76 $1.03

Reported earnings per Share Ì diluted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1.50 $1.73 $0.70

Add back: goodwill amortizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 0.28

Add back: trademarks and trade names amortizationÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 0.03

Adjusted earnings per Share Ì diluted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1.50 $1.73 $1.01

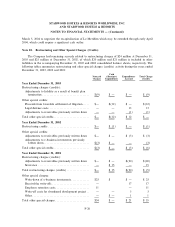

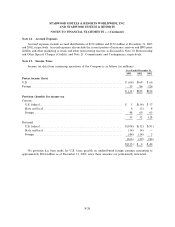

Note 3. SigniÑcant Acquisitions

Acquisition of Westin Savannah Harbor Resort and Spa. In July 2002, the Company acquired a 49%

interest in the 403 room Westin Savannah Harbor Resort and Spa for $25 million in connection with the

restructuring of the indebtedness of that property. See Note 20. Related Party Transactions for further detail

regarding the ownership structure of this resort.

Acquisition of Sheraton Centre Toronto. In April 2001, the Company completed the acquisition of the

remaining 50% interest not previously owned by the Company in the 1,377-room Sheraton Centre Toronto for

approximately $48 million based on exchange rates at the time. The Company accounted for the acquisition as

a step acquisition in accordance with APB Opinion No. 16, ""Business Combinations.'' The results of the

acquisition have been included in the accompanying consolidated Ñnancial statements since the acquisition

date.

Acquisition of Royal Orchid Hotel. In April 2001, the Company completed the acquisition of 44% of an

entity, which owns the 740 room Royal Orchid Hotel in Bangkok, Thailand for approximately $27 million

based on the exchange rates at the time.

The pro forma eÅect on the Company's revenues, net income and earnings per Share, as though these

acquisitions occurred as of January 1 of the respective years, is not material.

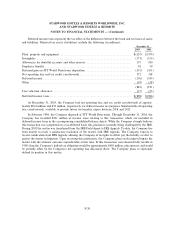

Note 4. Gain (Loss) on Asset Dispositions and Impairments, Net

During 2003 the Company recorded a $170 million charge related to the impairment of 18 non-core

domestic hotels that were held for sale and $11 million of subsequent charges primarily related to post-closing

adjustments to the sales prices. The Company sold 16 of these hotels for net proceeds of $404 million. The

Company also recorded a $9 million gain on the sale of a 51% interest in undeveloped land in Costa Smeralda

in Sardinia, Italy. This gain was oÅset by a $9 million write down of the value of a hotel which was formerly

F-20