SkyWest Airlines 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

(8) Special Items

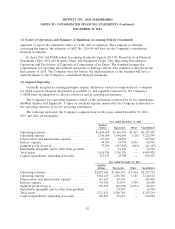

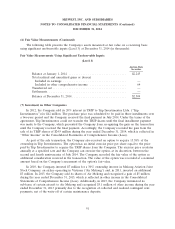

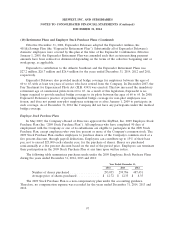

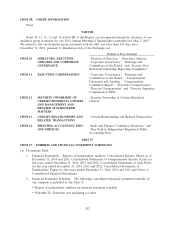

The following table summarizes the components of the Company’s special items, for the year

ended December 31, 2014, 2013 and 2012 (in thousands):

Year ended

December 31,

2014 2013 2012

Special items:

EMB120 aircraft related items(1) .................... $57,046 $— $—

ERJ145 aircraft related items(2) .................... 12,931 — —

Paint facility and related items(3) .................... 4,800 — —

Total Special items ................................ $74,777 $— $—

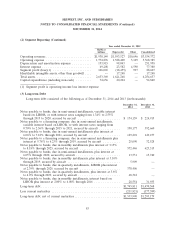

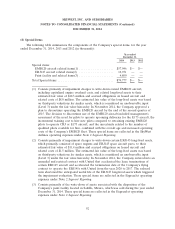

(1) Consists primarily of impairment charges to write-down owned EMB120 aircraft,

including capitalized engine overhaul costs, and related long-lived assets to their

estimated fair value of $48.3 million and accrued obligations on leased aircraft and

related costs of $8.8 million. The estimated fair value of the long-lived assets was based

on third-party valuations for similar assets, which is considered an unobservable input

(Level 3) under the fair value hierarchy. In November 2014, the Company approved a

plan to discontinue operating the EMB120 aircraft by the end of the second quarter of

2015. The decision to discontinue use of the EMB120 aircraft included management’s

assessment of the need for pilots to operate upcoming deliveries for the E175 aircraft, the

incremental training cost to hire new pilots compared to retraining existing EMB120

pilots to operate CRJ or E175 aircraft, and the uncertainty related to the number of

qualified pilots available for hire, combined with the overall age and increased operating

costs of the Company’s EMB120 fleet. These special items are reflected in the SkyWest

Airlines operating expenses under Note 2 Segment Reporting.

(2) Consists primarily of impairment charges to write-down certain ERJ145 long-lived assets,

which primarily consisted of spare engines and ERJ145 spare aircraft parts, to their

estimated fair value of $11.4 million and accrued obligations on leased aircraft and

related costs of $1.5 million. The estimated fair value of the long-lived assets was based

on third-party valuations for similar assets, which is considered an unobservable input

(Level 3) under the fair value hierarchy. In November 2014, the Company entered into an

amended and restated contract with United that accelerated the lease terminations of

certain ERJ145 aircraft and accelerated the termination date of the Company’s flying

contract to operate the ERJ145s with United from the year 2020 to 2017. The reduced

term shortened the anticipated useful life of the ERJ145 long-lived assets which triggered

the impairment evaluation. These special items are reflected in the ExpressJet operating

expenses under Note 2 Segment Reporting.

(3) Consists primarily of the write-down of assets associated with the disposition of the

Company’s paint facility located in Saltillo, Mexico, which was sold during the year ended

December 31, 2014. These special items are reflected in the ExpressJet operating

expenses under Note 2 Segment Reporting.

92